UK financial wellbeing in 2024: How can collections support customers through tough times?

According to the Office of National Statistics, the United Kingdom officially fell into a recession for the last quarter of 2023.

Now that 2024 has come around, real GDP has grown — but consumers remain under strain. Research from Money Advice Trust in June 2024 found that after inflation fell to its 2% target, 13% of UK adults — equivalent to 6.8 million people — say they are struggling to meet day-to-day costs

With more likely to miss a payment and slip into defaults, how can collections work with customers to find a way forward? Dive into what this economy means for Brits and how your recoveries strategy needs to adapt accordingly.

What does the current economy mean for Brits?

Rising energy prices, increasing cost of living and high inflation has been the reality for UK consumers since the COVID-19 pandemic.

The last two years have seen an 18.4% increase in the cost of living, with wage growth failing to keep pace. According to most UK households, the follow-on impact of this includes:

- 65% of households are in consumer debt, with 1 in 4 owing at least £5,000 across various credit commitments

- Over 4 in 10 households took out new credit in the last six months of 2023

- 15% of households borrowed money in November 2023 to cover basic daily living expenses, such as food and bills

The link between financial worries and mental health is widely known, with more than 1 in 2 people saying that thinking about their finances makes them feel anxious and 2 in 5 say financial worries are causing poor sleep.

How can collections better support financially strained consumers?

In an industry that deals first hand with the most financially vulnerable, how can collections support consumers with real solutions that take away stress and worry, rather than add to it?

1. Reduce pressure by offering realistic, flexible solutions

Pressuring customers to pay during an already-stressful period isn’t conducive to increased recoveries, or a great customer experience. Focus on generating positive outcomes that protect consumers from increased financial difficulty, a priority that’s also outlined in the FCA’s Consumer Duty.

When 2 in 3 UK adults who have interacted with a debt collector say the experience was “stressful”, it’s clear the industry isn’t currently meeting this requirement. Reducing pressure means providing supportive options, such as:

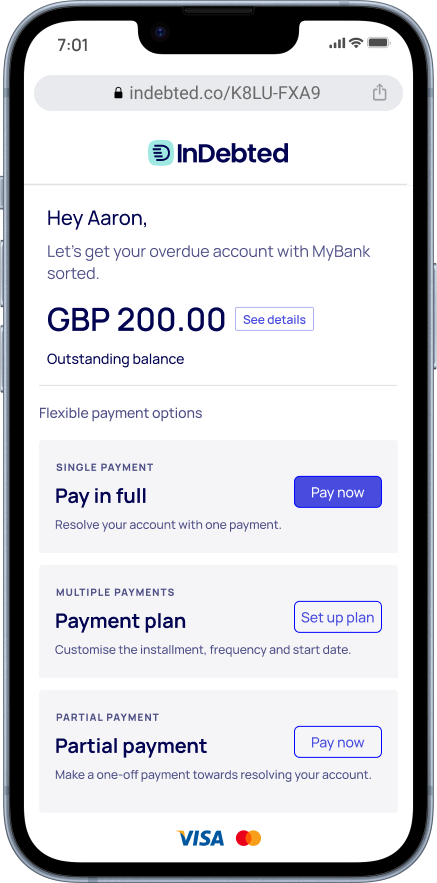

- For some, this could mean a customisable payment plan - with a start date, payment amount and frequency of their choice.

- Offering the option to chip away at their balance with one off payments at an amount of their choice. For many, this is a more realistic and supportive way forward than a payment in full, or even a payment plan.

- Snooze periods are also key to respecting customers and giving them breathing room until they’re in a position to manage their debt.

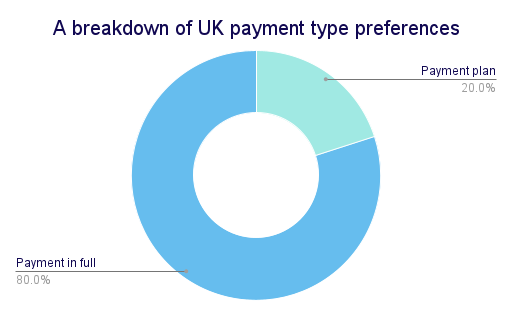

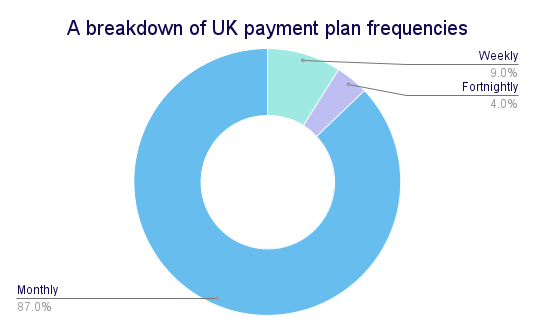

Our data shows that 1 in 5 UK customers prefer to set up a payment plan, and most choose monthly repayments.

2. Meet customers where they are with digital-first, omnichannel communication

From managing GP appointments to filing tax returns, more people are handling these tasks online. It’s time for collections to follow suit and embrace a digital-first approach to truly give customers the support they need.

The collections industry has historically been headcount intensive, with a heavy reliance on call centre agents making outbound calls and responding to queries. Although voice continues to be the most-used communication channel by UK debt collection agencies, its effectiveness is declining. For example, research found that call centre agents spend 30% of their working day on unsuccessful call attempts.

Our own research into the UK consumer experience of debt shows that 40% of adults are worried about receiving collections calls or physical letters. We also find that for every 24 InDebted customers who engage with our Customer Experience team digitally, only one picks up the phone. By introducing additional channels such as SMS, live chat and email, you can hit the mark with the 51% of UK adults who prefer digital contact.

There’s still a place for voice when used responsibly and as part of a diversified strategy. This is where omnichannel comes in. Omnichannel debt collection involves providing a seamless experience, regardless of what channel customers use to interact with you. This makes it faster, easier and more convenient for consumers to get back on track in a way that works for them.

3. Empower customers and provide convenience with self-serve

Since the pandemic, Brits simply have less free time. Commutes to the office, childcare commitments and household work are all filling up our day-to-day lives. Instead of expecting overdue customers to squeeze a collections call into their busy schedules, enable them to manage their debt on their own time, with self-serve.

Investing in self-serve capabilities enables customers to interact with you at their own pace. In debt collection, self-serve can take the form of online portals, support centres, and automated web chat for basic queries. When many people feel anxious about receiving collections calls or would simply prefer not to discuss their debt, it’s important to offer ways to manage their account that don’t involve direct interaction with agents.

4 in 5 customers referred to InDebted resolve their balance using our self-serve portal, without speaking to anyone from our Customer Experience team.

Step-up your self-serve game by enabling customers to entirely manage their payment plans through your online portal. This further reduces the need for agent intervention, so that customers can:

- Track their upcoming payment info including the amount and date, along with how they’re progressing clearing their debt

- Make one off payments to chip away at their balance if they’ve got extra room in the budget

- Integrate their payment plan dates with their Apple or Google calendar to stay on top of upcoming payments

Adding this layer of self-management does more than offer convenience; it empowers customers, and creates more efficiency in your operations.

Recessions are hard. Collections shouldn’t add to that.

When UK consumers are struggling to make ends meet, debt collection agencies need to operate with empathy, support and understanding. Pressuring people simply isn’t going to generate results. It’s time to design debt collection around consumer interests. With flexible payment offerings and convenient digital-first communication, overdue consumers can be provided with a better way to get back on track.

Learn moreJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.