Why 86% of customers prefer to self-serve in debt collection

When was the last time you called your bank to transfer money? Have you ever contacted customer service to check your account balance? How do you pay off your credit card each month?

When money can be managed online or through an app, why shouldn’t paying back debt be the same?

Let’s unpack what self-serve actually means in debt collection, and how it empowers more customers to pay back their accounts faster and easier than ever before.

What is self-serve?

Digital self-serve in debt collection is exactly what it says on the tin:

A collections solution that empowers customers to independently access information or manage their debt without having to speak with a human agent.

In collections, the ultimate self-serve capability includes:

- Easy-to-access online portal. This gives customers the ability to login and access their account from any device, at any time.

- When logged in, they can set up a customisable payment plan, make a payment, change a payment date amount, or check their outstanding balance. And that’s just a few examples. Ultimately, customers should be able to perform all account management activity themselves, without having to go through an agent.

- An online knowledge base, enabling customers to self-serve responses to frequently asked questions, concerns or issues in relation to their debt. With search functionality, clear categorisation and a well organised user experience, this empowers customers to access key information without having to go through Customer Support. You can see our very own Help Hub here. When 69% of customers prefer to attempt to solve their own problems before reaching out to support, the benefit of answering their questions on your website is clear.

When executed well, self-serve gives customers in collections convenience, control and autonomy. What’s more, research states that 81% of customers want more self-serve options. However, TransUnion recently found in a 2023 report that 64% of collections agencies don’t have self-serve capabilities, missing out on a huge opportunity to better support consumers.

Benefits of digital self-serve collections

1. The preferred choice of customers

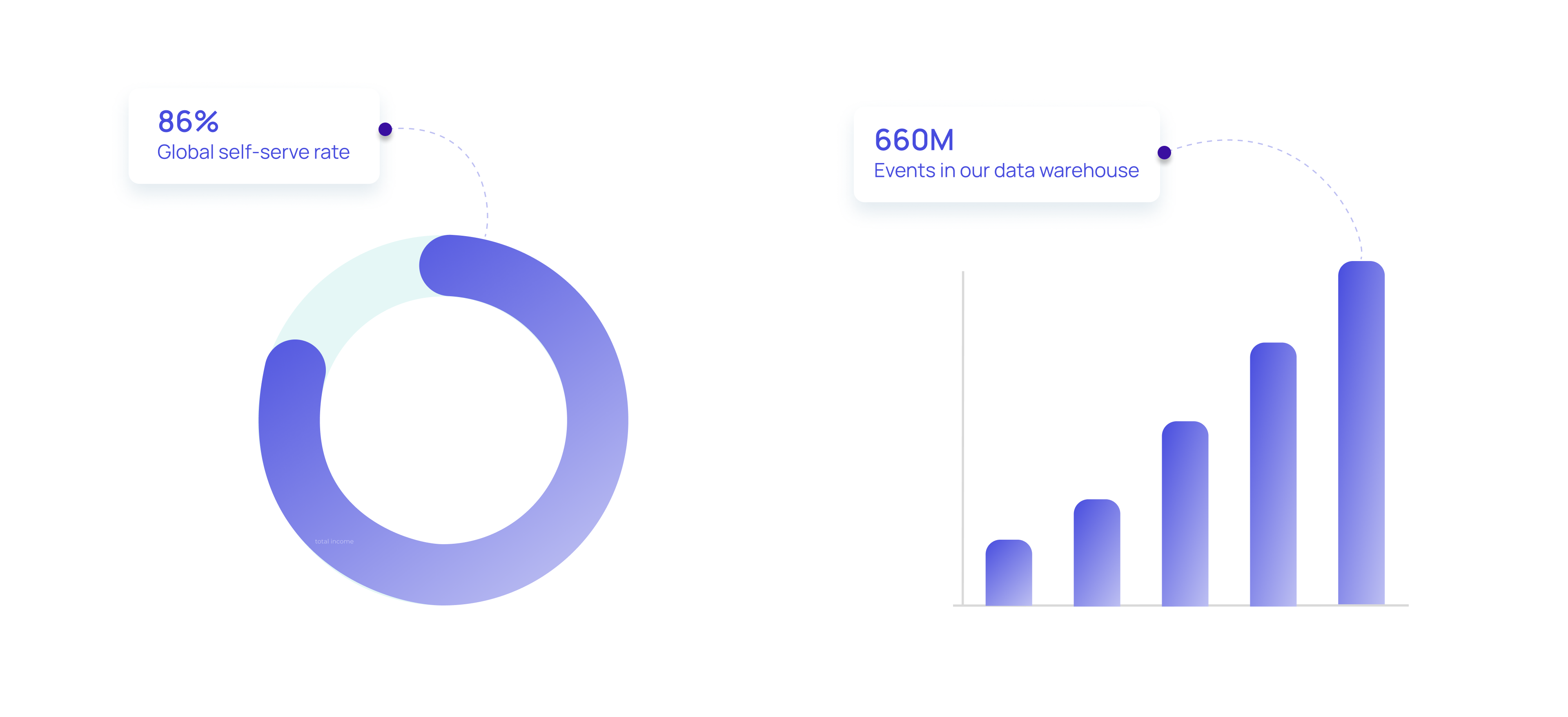

Out of all InDebted customers, 86% get back on track independently using our online portal. The main reason why? Convenience. Daily to-do lists fill up quickly, and ‘free’ time is fast declining. Customers everywhere look for ways to get things done faster, and on their own time. The easiest way to meet this need is to put the power back in their hands.

When we break down self-serve uptake across markets and industries, we see clear trends:

The highest self-serve rates are in the United States (93%), followed by Australia (80%). If we look specifically at debt type the greatest self-serve rates are from customers with overdue BNPL accounts. An astonishing 94% of customers from one of our largest United States BNPL clients self-serve their overdue accounts.

2. Increases your capacity to scale

Self-serve increases the volume of customers you’re able to support, and when account volumes surge, this unlocked capacity is crucial.

At InDebted, we use our customer to agent ratio to benchmark our scalability. Currently, this sits at 2.9 million customers (across five markets) to 80 agents. This demonstrates the power of self-serve, as it preserves our Customer Experience team members to handle more complex issues. With a global self-serve rate of 86%, our specialist team is always ready to support the 14% of customers who reach out for a helping hand.

3. Reduces pressure on customers

Talking about debt can be hard. Our research into the consumer experience of debt in the UK shows that around 2 in 3 adults say that their experience with a debt collection agency was ‘stressful’. The study also shows that 40% of Brits worry about receiving collections phone calls or letters. Especially when the link between finances and anxiety is becoming more apparent, forcing customers to speak about their debt isn’t always conducive to a positive collections experience.

Self-serve is more than just a tool for convenience, it empowers customers. Instead of exacerbating negative feelings, self-serve enables them to get back on track on their terms without additional pressure.

4. Gives you deeper insights into your customers

One of the most understated benefits of self-serve is its ability to access more data on how customers engage with their debt. Especially when integrated with an omnichannel collections strategy, you can understand behaviours and preferences such as:

- Which customers are most likely to self-serve? What’s their average balance or what product did they originate from?

- Did they login to the online self-serve portal from an email or SMS link? Which channel are they most likely to engage with?

- What times are customers most likely to self-serve? Does this fluctuate across balance sizes or originating products?

Through our years of offering this capability, we’ve given clients across the world actionable insights about their customers who fall behind. This empowers their internal teams with a rich understanding of how their customers prefer to engage, what channels they use and much more.

5. More room to build new features

Developing your self-serve capability gives you a clear path to grow your offering. Once you have your online portal up and running, you can regularly add new features to support customers on an ongoing basis. This could include:

- Payment plan management options for customers to amend their plan schedule or edit their instalment amounts

- Notifications or downloadable calendar reminders for payment plan customers to stay on top of their upcoming payments

- An option for customers to make one-off payments separate to their payment plan if they have a little extra room in their budget

- Financial wellbeing resources such as affordability calculators for customers looking for additional support

Look at what customers are reaching out for, to understand which new features could be most useful. For example, are a large proportion of enquiries related to payment plan amendments? Or are customers calling to check when their next payment is due? Sophisticated self-serve capabilities can support customers to do more than just get back on track, but help them stay on track.

Self-serve: More than meets the eye

As the number one choice for over 4 in 5 of our customers globally, the overwhelming preference for self-serve is clear. It gives your customers the autonomy that’s historically been forgotten in collections, and enables your business to focus on more strategic, long-term gains. That’s a win-win for both your customers, and your business.

Learn more

Join our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

Collections emails impacted by new spam requirements? See exactly how we achieved a user-reported spam rate of 0.2%.How we use AI to increase email payments by 32%

Collections communications not landing with customers? See how AI-written collections emails increase payment conversions by 32%.The ins and outs of our Product Roadmap

Get the inside scoop on what's in store for our product, Collect this year.Why 86% of customers prefer to self-serve in debt collection

Stay on hold or do it yourself? Self-serve is the new standard in debt collection. See why it’s a win-win for your customers, and your business.