Supercharge your collections with intelligence

Traditional debt collection

- Contact centre based

- Communicates with customers through phone calls and letters

- No data-informed decision making

- Non-existent customer self-serve capability

- Customer engagement rate of 0.5%

Intelligent debt collection

- Product led, continually improving and deploying new features

- Omnichannel communications across all voice and digital channels

- Informed by sophisticated data science on how customers prefer to engage with debt

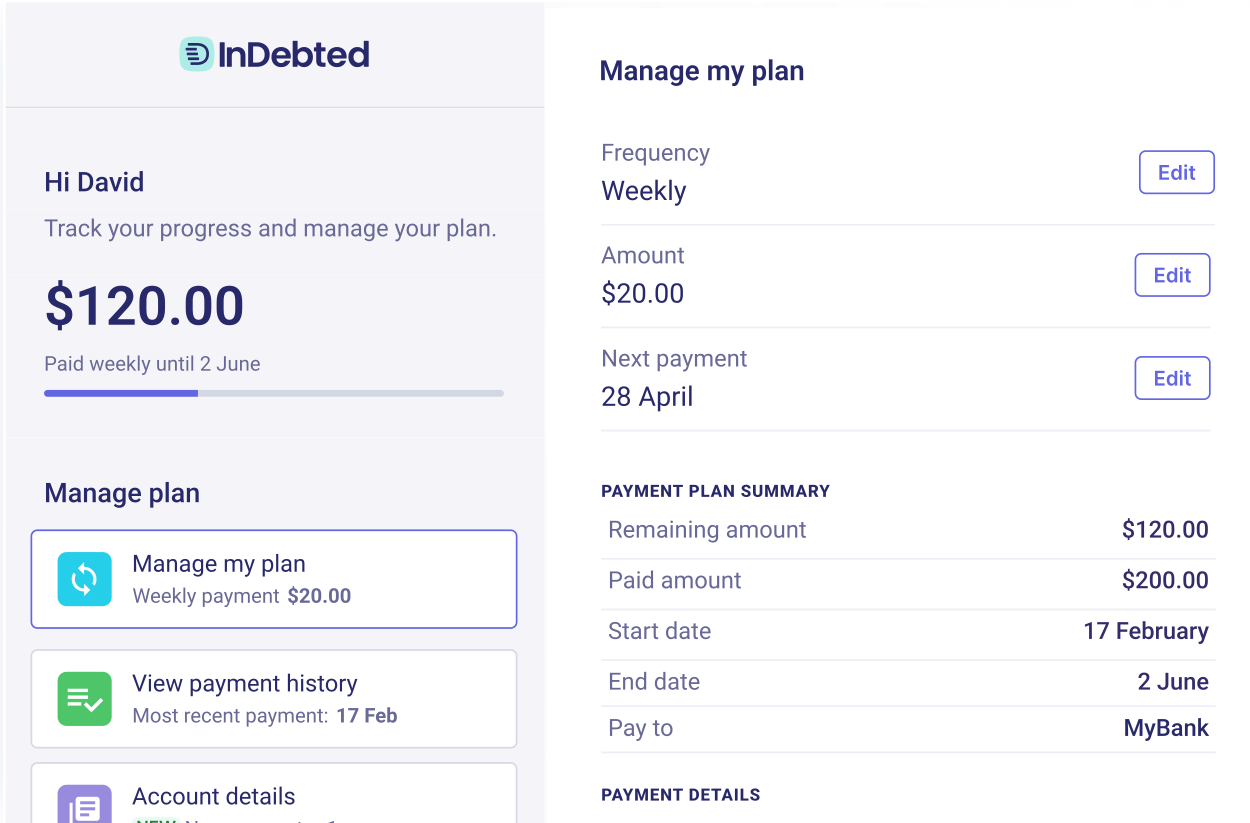

- Empowers customers to self-serve entirely, with agents available for support if needed

- The industry’s highest engagement rate of 5-7%

Digital debt collection

- Platform based

- One-size-fits-all digital engagement strategies

- Basic use of data and analytics

- Basic customer self-serve capability

- Customer engagement rate of 3%

How Collect works

The need-to-know

Collect specialises in collecting unsecured consumer accounts. Powered by personalisation, our product uses data science to inform the best way to communicate with your customers in a way that’s completely individual to them. This creates empowered customers who actually want to manage their debt, rather than withdraw and disengage from it.

Collect benefits your team with faster liquidation and increased recovery rates, provides one unified collections voice across multiple jurisdictions, and protects your customers from a poor experience that can result in time spent dealing with complaints and support requests. Our client portal enables you with access to a real time dashboard with key performance data, and you can also easily recall, confirm, and resolve customer requests. Collect saves time spent managing collections internally, so that you can focus on your businesses’ future growth. Read about how Collect has supported organisations such as Klarna here.

Enabling customers to manage their debt digitally is more convenient and empowering, and our empathetic approach sees higher engagement. Our data science models tell us the best method of reaching your customers, and by providing flexible and manageable payment options, they engage with their debt faster, proactively, and more sustainably.

Our pricing model is contingent, meaning InDebted keeps a percentage of the amount recovered. The exact percentage depends on a few factors specific to your company, such as size and debt type, so we’ll need you to get in touch so we can give you accurate pricing info. Get in touch here.

The recoveries backbone for the worlds most innovative and trusted financial institutions.

InDebted’s real time scalability with leading BNPL provider

InDebted partners with a publicly-listed BNPL provider whose mission is to power an economy in which everyone wins

InDebted’s real time scalability with leading BNPL provider

InDebted partners with a publicly-listed BNPL provider whose mission is to power an economy in which everyone wins How Trustly maintained collections performance while increasing referrals 12x

What happens when account volumes suddenly surge? See how Trustly scales collections in real-time, and maintains performance.

How Trustly maintained collections performance while increasing referrals 12x

What happens when account volumes suddenly surge? See how Trustly scales collections in real-time, and maintains performance.