Omnichannel debt collection

Make it faster and easier for customers to get back on track with a frictionless omnichannel experience.

See omnichannel in action0%

Higher engagement than voice based strategies

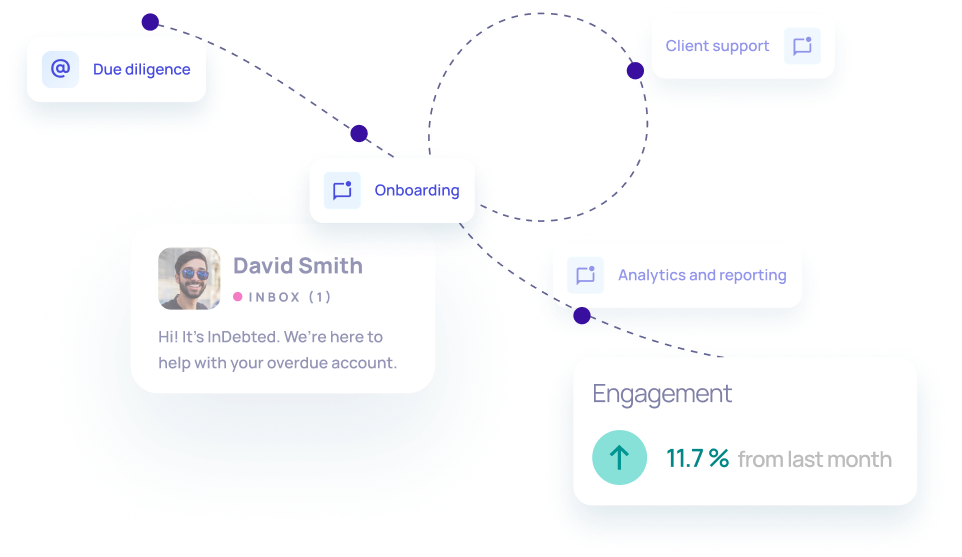

Inbound and outbound, voice and digital. Omnichannel debt collection maximises every single customer touchpoint to drive higher liquidation.

Engage customers on the channels they prefer

Streamline your customer experience

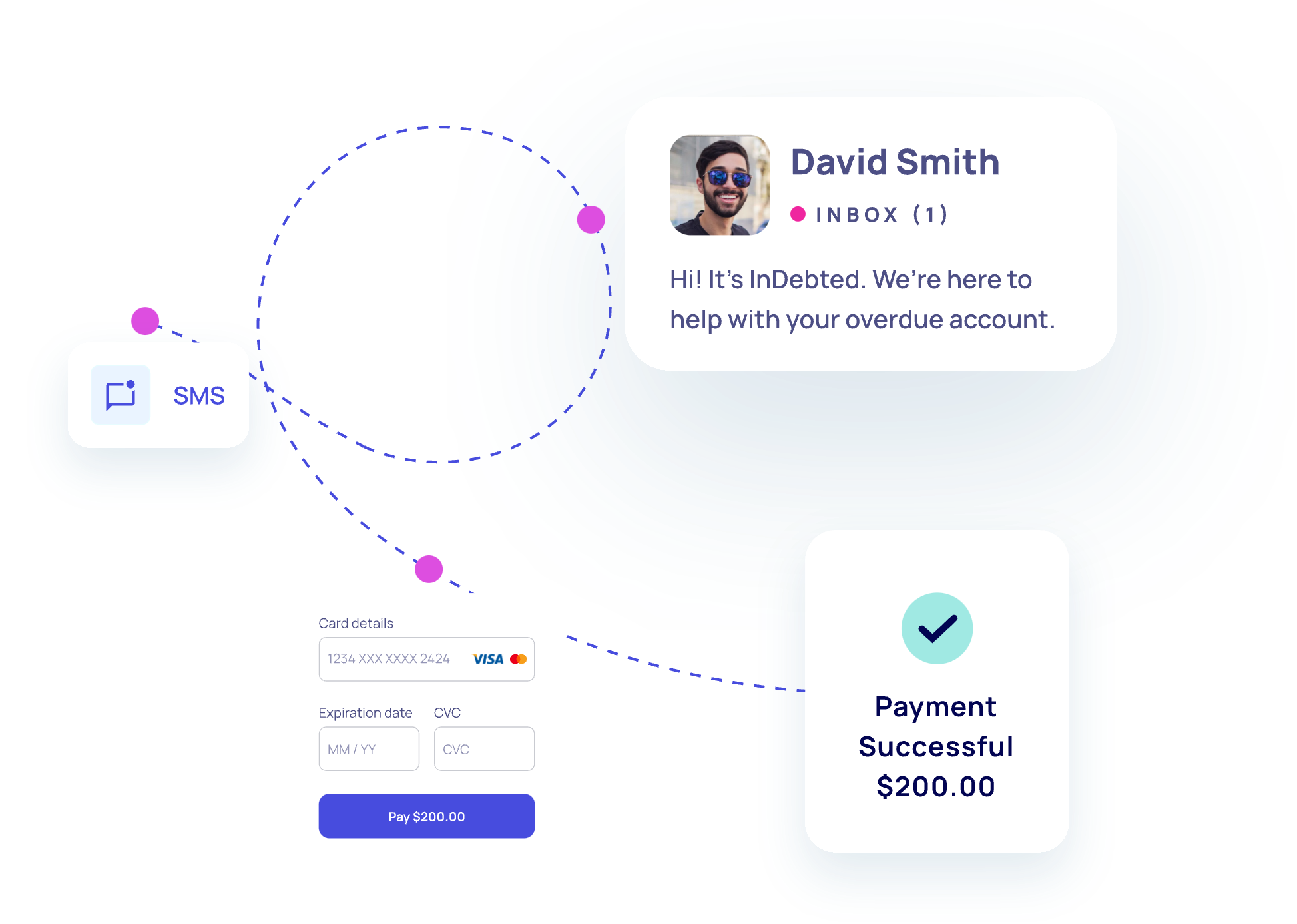

Omnichannel debt collection means supporting customers through multiple channels, including live chat, phone, email, SMS, and self-serve functionality. True omnichannel creates a consistent experience across each of these touchpoints – enabling customers to continue the conversation where they left off. If their last contact was an email, the agent answering their call should be able to see their full contact history, supporting the customer to a seamless resolution.

See it in fullIn traditional third party debt collection, 78% of calls are blocked. Using multiple channels to engage customers is now a non-negotiable for any modern collections department. And in every interaction, customers expect you to know their journey so far to provide individualised support. Omnichannel debt collection enables you to continue the conversation with a customer, regardless of what channel they use to engage. The result? Faster resolution, a connected experience and engaged customers.

See it in fullOur omnichannel debt collection has three core pillars.

1. Personalised outbound communication

No two customers are the same, why would their collections journey be? We use machine learning and artificial intelligence to inform every aspect of our outbound communication. Our models create a unique experience for each individual, based on their personal preferences and behaviour. Down to the time a message is sent, all touchpoints are maximised to craft a collections journey that customers want to engage with.

2. Customer experience

To support those who need a helping hand, our specialist Customer Experience team is available globally across all voice and digital channels. With over 2300 5* reviews from customers across the world, they’re always ready to help customers turn things around.

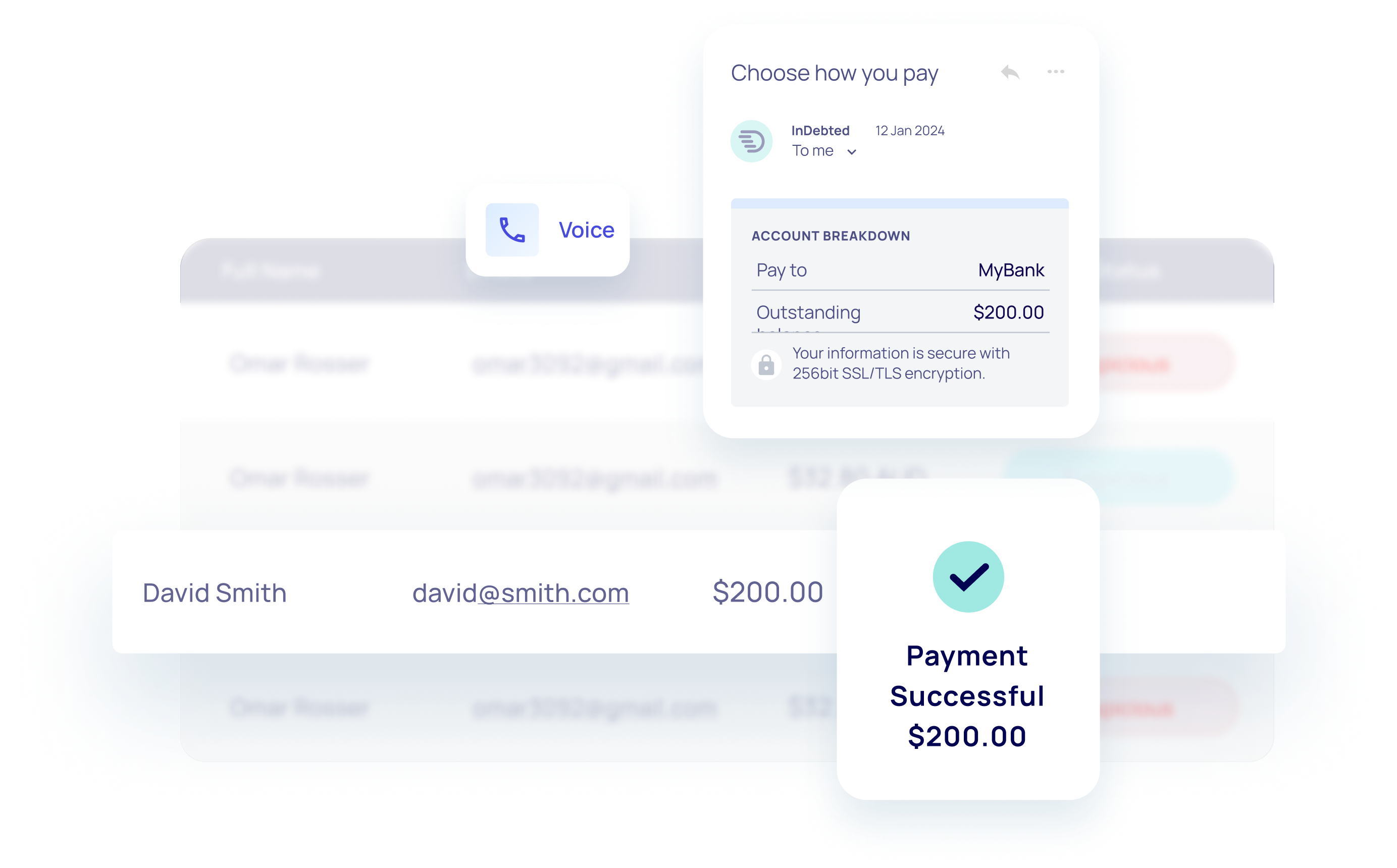

3. Self-serve customer portal

86% of customers referred to InDebted get back on track independently, using our customer portal. More than just a payment platform, it lets customers manage their account end-to-end at their convenience - without the barrier of speaking to an agent first. This lets us get out of the way, so customers can get back on track.

Simplifying collections for global businesses

We've received your request.

We'll be in touch shortly to organise next steps!