SUBSCRIPTIONS AND PAYMENTS

Recover your open debt portfolio without impacting your brand

We've received your request.

We'll be in touch shortly to organise next steps!

Outstanding payments could be costing over 10% of your annual revenue

Writing it off doesn’t have to be.

“Customer experience is critically important to Trustly, and InDebted's omnichannel collections approach is core to how we support our loyal customers when something unexpected happens.“

Rakesh Teckchandani

Senior Director Risk Product

Modern collections for customer-centric brands

Companies such as Trustly and Klarna partner with InDebted to empower their customers to manage their overdue balance, their way.

Led by technology, with a human touch

Driven by data

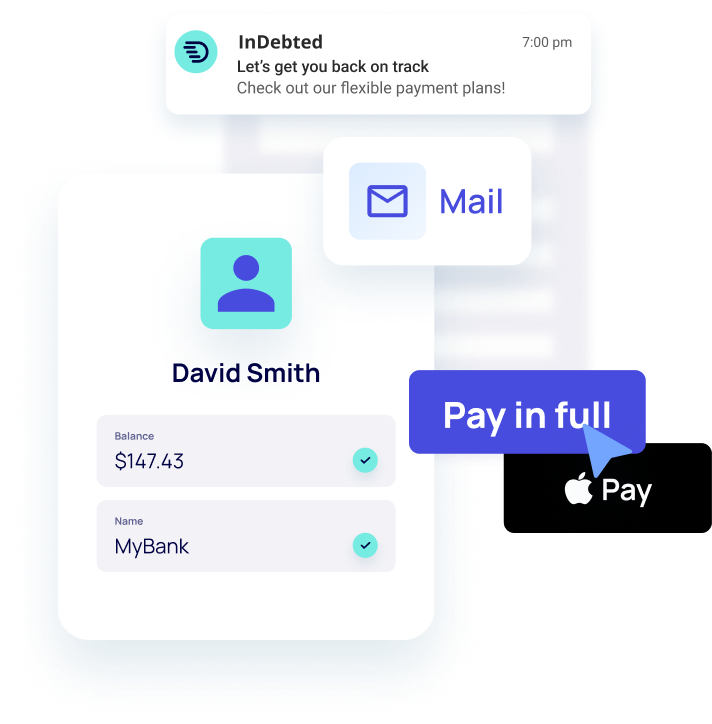

Machine learning models know how to engage customers at a time that suits them best, with friendly messages that convert.Omnichannel engagement

A streamlined, cohesive customer experience. Enable people to communicate and manage their debt how they choose.Up to 40% increased liquidation

Compared to traditional debt collection methods, our approach is more effective and compassionate while delivering leading results.

Reactivate failed payments back into returning customers

A better experience

With a positive collections experience, you can re-engage churned customers and boost lifetime value.

86% of customers self serve

A digital-first journey built for ease and convenience, with no unnecessary pressure or friction.

Flexible payment options

Customers can pay in full, customise their own payment plan, or pick an option in between.

Supported by people who care

Our compassionate team is here to support – with an average 4.9 star rating from 2,500+ customer reviews.

Trustly partners with InDebted to generate 20x higher collections performance

Challenge

- 2023 was a year of rapid growth for Trustly, reaching $58 billion in annual transaction value – a 79% YoY increase.

- In this period of growth, their monthly collections referrals increased 12x.

Impact

- Trustly’s collections performance increased by 20x, with Collect successfully recovering $4 million USD in otherwise lost revenue.

- 70% of Trustly’s customers self-serve their accounts, and 4 in 5 have resolved their balance in full with an easy and convenient collections experience.

“We want to empower our customers to resolve their overdue balances in a way that truly works for their circumstances. InDebted makes that seamless. Finding a collections partner that can support our growth, while still providing an exceptional experience for our customers is a win-win.“

Rakesh Teckchandani

Senior Director Risk Product

Track real-time engagement and recovery performance

Contingent pricing model

Commission-based pricing around your account volumes, balances and specifications.Easy implementation

A third party collections extension between our product and your internal system.Enterprise partnership

Dedicated CSM support to maximise customer experience and drive ongoing performance.Trust & compliance

ISO certified, SOC 2 and PCI compliant, fully licensed in all operational markets.

“Partnering with InDebted has saved us the time, cost and inefficiencies of needing a new supplier in every region. InDebted is a key part of us delivering our customers a better way to shop, globally.“

Jan Hansson

VP, Collections

Scalable to support growing organisations