5 ways our product is the perfect match for BNPL customers

Buy Now Pay Later (BNPL) providers have taken the world by storm offering an easier way for consumers to make purchases up front, without requiring traditional forms of credit.

1 in 3 Americans use Buy Now Pay Later, and the US market alone saw a 970% increase in BNPL loan originations between 2019 and 2021. With demand for these services high, what do BNPL customers entering into collections need to get back on track? Let’s explore this in more detail using collections insights from our work with 13 of the largest BNPL providers in the world.

1. Customisable payment plans mirror the BNPL experience

Buy Now Pay Later services are exactly what they say on the tin. Customers get to decide how they ‘pay-later’, with customisable options to choose from. This can include breaking the sum up into biweekly or fortnightly payments, lasting anywhere from 30 days to three months.

With this in mind, these customers deserve that same level of autonomy if they fall

into collections. Enter - flexible payment plans, which enable customers to decide the amount they pay, how often they pay, and how long they pay for - even when they’re ready for the payment plan to start. This enables them to create a bespoke payment schedule that fits their individual situation.

When we look at how real BNPL customers prefer to resolve their debt through payment plans, it’s clear that they welcome this level of customisation. Interestingly, almost 1 in 2 opt for biweekly payments, and 90% resolve their account within 12 months. The average instalment amount across Australia, Canada, New Zealand and the United States is $46.03 and the median plan duration is 98 days.

2. Flexible payment options for convenience

Convenience is an understated driver of BNPL’s success. This doesn’t just include when and what they pay, but also how.

Digital wallets like Apple and Google Pay have seen similar growth to BNPL services, with 51% of consumers now stating they would stop shopping with a retailer that doesn’t accept digital wallet payments. With a simple double click, face ID or passcode, transactions couldn’t get any easier.

At the start of 2023 we introduced Apple Pay and Google Pay into our product. Apple Pay continues to be most popular with BNPL customers - who account for over 3 in 5 of Apple Pay transactions in Collect. To make the case for digital wallets even stronger, when we compare its impact against all other payment types, customers choosing Apple Pay have the highest conversion rate of 93.3%.

The consensus is clear - leaning in to how consumers want to make transactions is a winner. When it comes to collections, it’s up to us to make it easy and convenient for customers to engage - and with 53% of consumers stating that they use digital wallets more often than traditional payment methods, it’s a no-brainer.

3. Self-serve, digital-first engagement

It’s no secret that BNPL is popular with Gen Z - the largest generation. Almost 3 in 5 18-25 year olds have used the service at least onc e, and it’s become a staple shopping solution globally. There’s numerous reasons why BNPL services are a hit with younger folks, but a key factor is the digital-first experience.

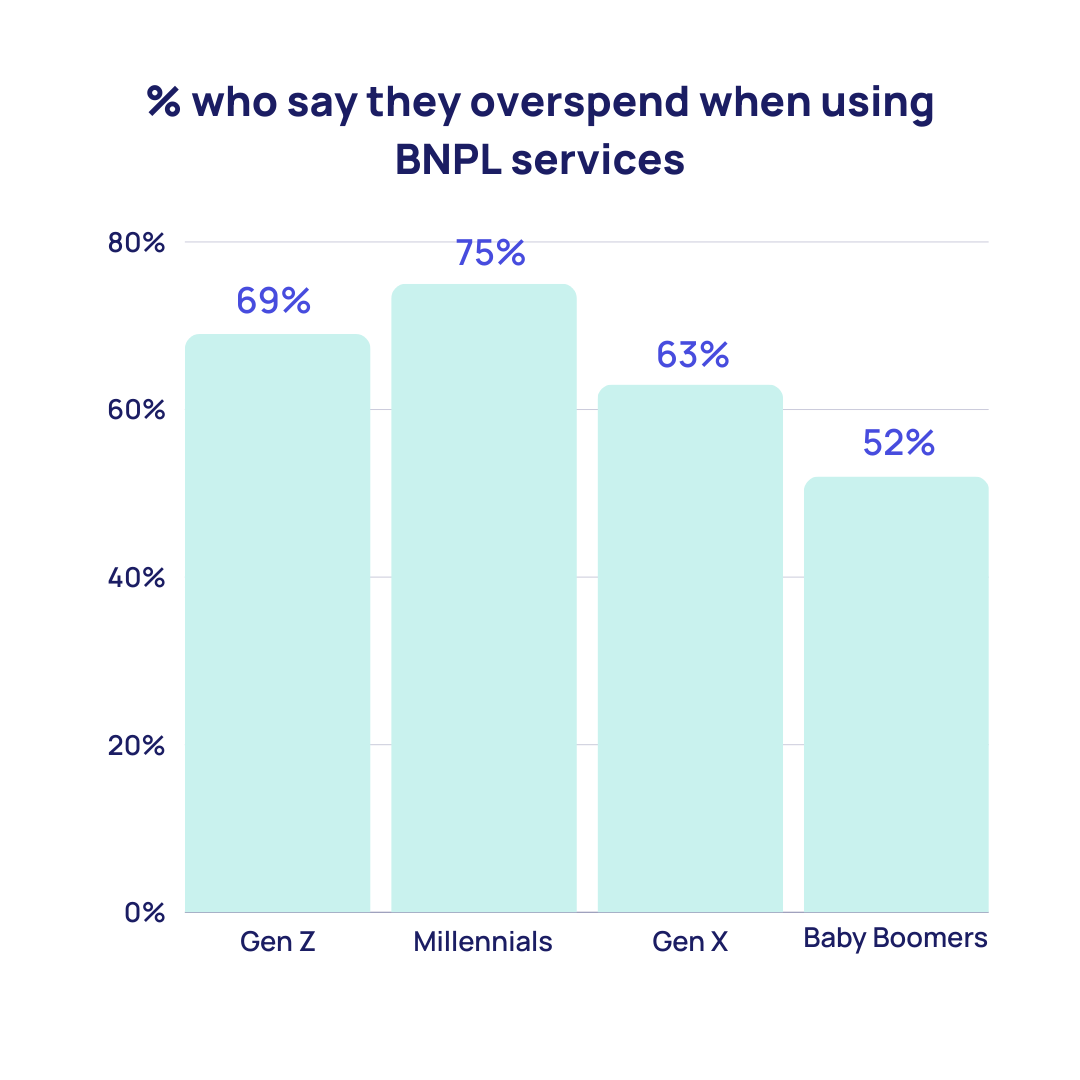

Gen Zers are the first generation to have used digital devices almost from the get-go, with no experience of living in an offline world. To hit the mark with this cohort, who are also the second most likely (after Millennials) to overspend when they use BNPL, a digital-first collections experience is a necessity.

Being digital-first is core to our Collect product, providing two way communication to customers across multiple channels such as email, livechat and SMS. We see an obvious shift in this direction when we look at how BNPL customers prefer to engage with their debt - focusing specifically on Klarna customers referred to InDebted who have a 63.9% open rate and a 43.4% conversion rate with Collect. Our open rates are markedly higher than both the industry average of 27.8%, and a competing digital debt collection agency who reports an average of 52%.

4. Total personalisation with collections intelligence

Consumers need a personalised experience - according to Salesforce research, 66% expect a company to understand their unique needs. This goes beyond using their first name in an email, but truly understanding their behaviours and preferences. Major BNPL providers do this well, with dynamic apps that offer tailored recommendations that suit each customer’s shopping history.

Personalisation is what sets intelligent debt collection apart. Our Collect product is powered by machine learning models that tailor each customer’s collections journey to how they prefer to engage. The models use the industry’s largest data warehouse which holds over 500,000,000 customer interactions to create the ideal collections experience for every person. Our latest models include:

Customer Journey model

What it does: Identifies precisely where a customer is in their collections journey and what (if any) interactions they’ve already had with their debt. Once the model knows where someone is on their journey, it tailors their next message exactly to this.

Impact: Increased email conversions by 7.32% and SMS conversions by 11%.

Message recommender

What it does: Selects a message that has the right tone, content and call to action for an individual customer, so they’re most likely to feel empowered and take action.

Impact: Increased conversions by 6.9% and click rates by 5.4%

Email scheduler

What it does: Ensures that emails land in a customer’s inbox at the exact time they’re most likely to take action.

Impact: Increased email payment conversion rates by 20%

5. A trusted collections solution verified by real customers

All of the above are vital to the ideal BNPL collections experience, but what ties them all together? Trust. The rapid adoption of BNPL has been fuelled by positive experiences. The data backs this up too - p eople who have a positive emotional experience with a brand are 15 times more likely to recommend them, and 8 times more likely to trust them.

In debt collection, you’re starting on the backfoot. Customers already have a negative perception of the industry and you have to work harder to earn their trust. In practice this means putting their needs and feelings first every step of the way, from how communications are written, to how agents are trained. It comes from appreciating how difficult finances can be and recognising that sometimes, all we need is a helping hand.

That’s exactly why we built intelligent debt collection to become the highest customer-rated agency. It’s about more than providing an easy way for customers to get back on track, but truly changing the experience of being in debt. This review from one of the world’s largest BNPL providers says it all:

There you have it, why intelligent debt collection is the first choice for the BNPL industry. With Collect, customers experience a collections journey as frictionless and flexible as the BNPL provider their debt originates from - it’s a perfect match.

See how it worksJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

Collections emails impacted by new spam requirements? See exactly how we achieved a user-reported spam rate of 0.2%.How we use AI to increase email payments by 32%

Collections communications not landing with customers? See how AI-written collections emails increase payment conversions by 32%.The ins and outs of our Product Roadmap

Get the inside scoop on what's in store for our product, Collect this year.Why 86% of customers prefer to self-serve in debt collection

Stay on hold or do it yourself? Self-serve is the new standard in debt collection. See why it’s a win-win for your customers, and your business.