Based on our analysis of key market trends, and supplemented by insights from industry leaders and experts who are actively shaping the future of collections, here are our predictions for how the debt collection industry will evolve in 2025. We hope it’ll help you to plan effectively for the year ahead.

Mejor deuda

Al reunir todos los rincones de las colecciones para compartir conocimientos del mercado y nuevas perspectivas, Better Debt arroja luz sobre el avance y la innovación en nuestra industria. Mire grabaciones pasadas o vea eventos futuros para unirse a la conversación en vivo

AI and Machine Learning Masterclass

Where do you start with implementing AI in Financial Services? Get the download from industry experts Josh Foreman (CEO & Founder, InDebted), Mike Zhou (Chief Data Officer, InDebted), Jo Mikleus (AI Strategic Advisor & Non-Executive Director) and Duhita Khadepau (Senior Manager - Enterprise Data, Cuscal Limited) With Jo, Duhita, Josh & Mike

Scaling a global collections function

Learn how scaling experts Klarna built their collections function from the ground-up to take their collections across continents. Live in 45 countries for over 150 million active customers, we sit down with Jan Hansson. With Jan, Josh & Hugo

Supporting borrowers in a shifting economy

Unpack what the shifting macroeconomic environment in the United States means for both creditors and collections. Joined by Transunion's Dan Simmons. With Dan, Josh, Laura & TimNuestras ideas sobre colecciones

Guías, recursos y datos que puede utilizar para llevar sus colecciones al siguiente nivel

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.AI debt collection vs. traditional methods: what's different?

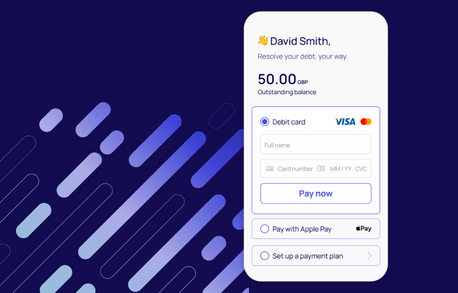

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Debt collection industry predictions for 2024

Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.Historias de clientes

Lea nuestras historias de éxito de clientes y descubra por qué InDebted es el socio de cobros para organizaciones líderes

Blog de producto

Manteniéndolo informado sobre los lanzamientos de nuestros productos, actualizaciones de rendimiento y planes futuros.

How we use machine learning to create 20% higher email payment conversion rates

Read about our latest machine learning model, the message scheduler and how it makes sure emails land at the perfect timeWe asked real people in debt what they wanted from a debt collector

Read what real customers want from debt collectors and how we’re taking it forwardAccess visibility into your customers accounts’ performance with our new Portal feature

Read about our latest client feature and how it enables real-time access into how accounts are performing, and moreView InDebted’s commitment to security with our Vanta trust report

Access InDebted’s Vanta trust report to see how we keep your business and customers safeSala de redacción

Manténgase al tanto de nuestras grandes noticias, anuncios y cobertura mediática reciente

InDebted enters the Mexican market, partnering with APLAZO.MX to revolutionise debt collection in the region

InDebted, a global leader in technology-enabled debt collection, has announced its entry into the Mexican market. With this launch, InDebted aims to empower consumers throughout Mexico with innovative solutions that support them to take control of debt.

Strengthening our Legal, Risk and Compliance function

We’re proud to have not just one, but two highly regarded leaders in the Risk, Compliance & Legal remit at InDebted. Laura White has joined InDebted as Chief Risk and Compliance Officer, while Tim Collins has been appointed as General Counsel.

InDebted launches into the UK, finding that 2 in 3 Brits dealing with existing debt collectors experience “stressful” treatment

Read findings from new research that highlights the impact of the broken debt collection industry in the UK on consumers

InDebted Secures $25M in Series B Funding

Read how InDebted hit a funding milestone, to continue changing the world of consumer debt recovery for goodDentro endeudado

Historias sobre nuestro equipo, cultura y propósito de cambiar para siempre el mundo del cobro de deudas de los consumidores.

Changing the debt collection industry for good, one positive experience at a time

Read why 2,000 customers rate InDebted as the top collections agency in the worldReflecting on 20 years in the collections industry and embracing a new chapter

With almost two decades of experience, read Tracy Glen’s reflections on her time in collections and where the industry is headedTaking the shame out of debt and putting the human back in

Read why 2,000 customers rate InDebted as the top collections agency in the worldHow Josh Stephens champions climate change action in the workplace

Read how Josh brought his passion for the environment into InDebted