Debt collection industry predictions for 2024

In 2023, The World Bank’s warning that the global economy would come ‘perilously close’ to a recession became a reality. As we step into 2024 still navigating uncertain waters, financial outlooks are still predicting that we’ll see the symptoms of a stretched economy through sustained inflation and interest rates.

This will undoubtedly continue to impact delinquency rates around the world. Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024.

How to prepare, what’s in store, and our expert tips

Over a decade on from the global financial crisis (GFC) that plunged the world into a tailspin of economic downturn, the symptoms of elevated interest rates and widespread inflation are starting to show once again. Using delinquencies as a barometer, the stress on markets worldwide can be seen:

- In the United States, consumer loans, auto and credit card delinquency are topping pre-pandemic numbers, with bankcard and personal loans showing signs of increased early delinquency levels in recent vintages

- In the United Kingdom, unsecured delinquency rates are starting to rise, with most product types approaching pre-pandemic levels

- Symptoms of mortgage pressures are being seen in Australia, particularly from early delinquencies. 30-89 day delinquency rates increased by 42.9% from Q2 2022 to Q2 2023

Rising delinquencies can be an indicator of what’s to come for the global economy. How can credit providers adopt a collections strategy that meets modern consumer expectations, while securing your commercial needs when the course changes? The overarching lesson from the GFC is that preparedness is essential. Keeping a close eye on changes in the consumer landscape, taking steps to increase institutional resilience, and strengthening your collections capabilities is critical.

Let’s take a closer look at the essential elements needed in today’s climate for an effective recoveries strategy, and why early adoption is key to collections success in 2024.

1. The rise of omnichannel debt collection

A 2019 McKinsey & Company study showed that across high and low balances, credit card customers prefer to resolve their debt through digital channels rather than traditional methods like phone calls. This was most significant for balances that were 30 days past due (DPD), with 23% more customers making partial or full payments using digital methods.

The increase in remote working since the pandemic has amplified both the consumer need—and expectation—for services at convenience. Particularly in the post-pandemic landscape, where driving maximum engagement in collections means meeting customers via the channels they interact with on a daily basis.

Interestingly, the same McKinsey research also identified a subset of credit card customers with larger overdue balances on financial products who prefer traditional contact methods. They had the following attributes:

- 44 years-old and above

- Pay their balance in full

- Have never used their account digitally or via an app

This tells us that while digital channels are key to meeting consumer expectations and enabling them with more autonomy, collections providers need to be responsive to the channels people prefer. Whilst the self-service rate for customers referred to InDebted has increased across the UK, US, Australia and Canada (peaking at 91% in the US during 2022), approximately 1 in 5 customers contact our Customer Service team for support or guidance.The highest proportion (22%) of such interactions were customers who wanted to pay their balance in full - aligning with McKinsey’s own research.

Anticipating the needs of consumers means providing an omnichannel experience that looks at the end-to-end customer journey, and how each channel forms a vital stepping stone on the pathway to debt freedom. Delinquent accounts will likely rise, so it’s essential to have a multifaceted offering that provides options and flexibility for consumers.

2. Increased focus on customer experience through economic uncertainty

During times of financial difficulty, considered customer communications are essential. This applies to the debt collection industry more than most, as both a highly regulated and stigmatised sector.

The need for empathetic & customer-focused messaging extends beyond regulatory requirements - it’s also been proven to drive 40% higher engagement and conversion rates. From consumer research conducted in 2022, we found that 1 in 2 UK adults have encountered harassment or aggression from debt collectors. This contributes to the traditional debt collection industry’s average engagement rate of below 1%, high complaints, and a generally poor reputation.

In the face of uncertainty, tensions also give rise to sudden policy amendments and legislative changes. After the 2008 crisis, we saw sweeping reforms brought into the financial sector, including the Consumer Financial Protection Bureau in the USA, stronger banking regulations in Australia, and the Financial Services (Banking Reform) Act in the UK. During the pandemic, restrictions were placed on escalating recovery practices. The golden thread between them all? Global downturns trigger an amplified focus on protecting those in debt from entering further financial difficulty.

Agencies that place customer experience at the centre of their operations will be in a stronger position to generate better outcomes throughout 2024. Where the vast majority of collectors will be forced to retrospectively unpick harmful practices, credit providers should look closely at their collections partners’ current processes and communication with customers.

3. Personalisation will replace segmentation as a key liquidation lever

In the last few years, segmenting customer profiles has been cited as an industry advancement in collections. This is a key feature in standard risk-based collections, involving scorecards that use factors such as account balance, age of debt and financial stability to determine treatment strategies.

These linear approaches may have been sophisticated when they were first introduced, but they no longer hit the mark. To match what consumers are experiencing across other industries, personalisation is the way forward for the debt collection industry in 2024.

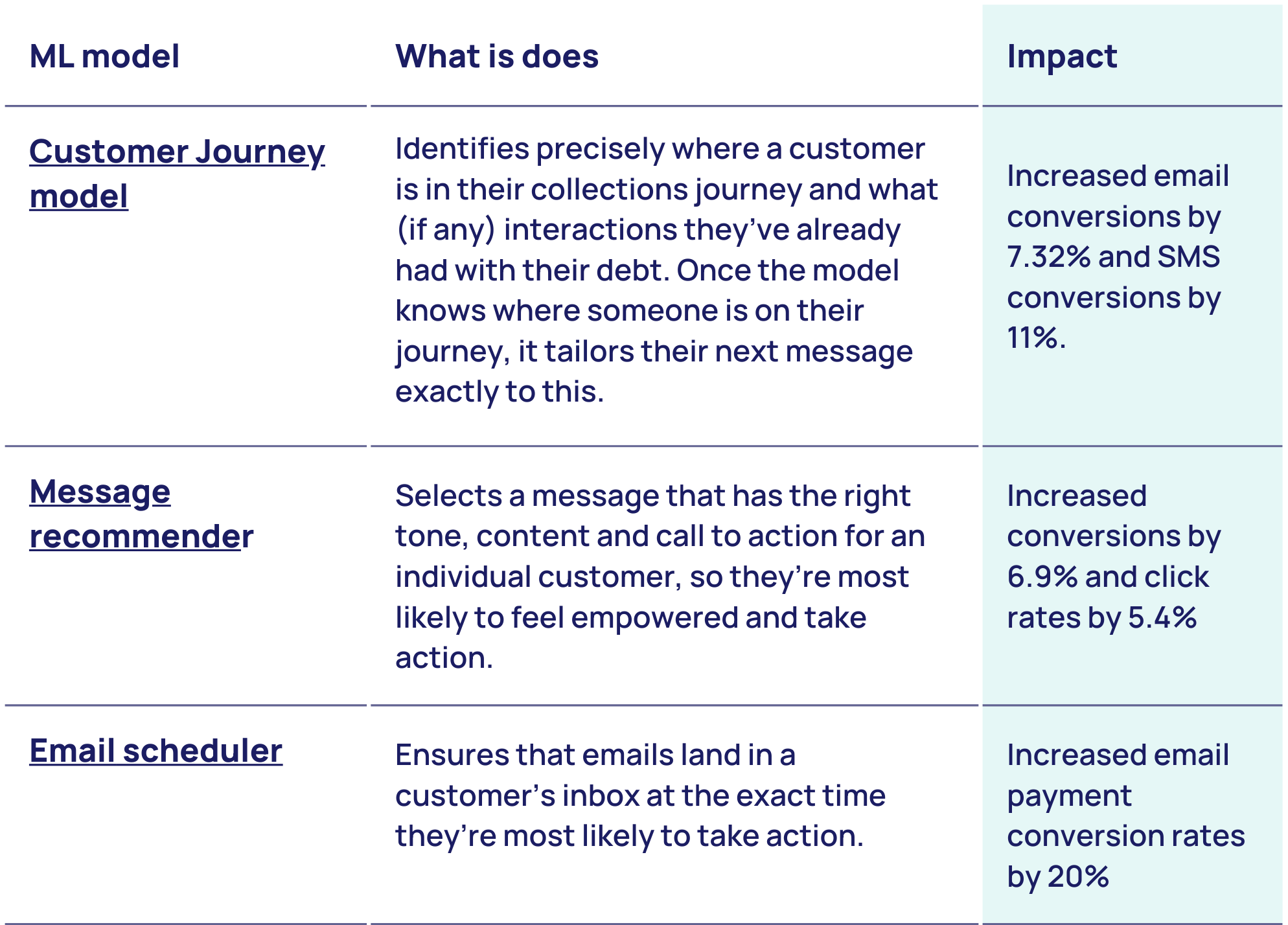

Creating an individualised journey for every customer starts with applying real-time data and insights to your collections decision making. At InDebted, we use machine learning models to craft an intuitive collections experience that’s entirely personalised to how each individual engages with their debt.

How does machine learning personalise the collections experience?

Machine learning models can be used to personalise targeted elements of every single customer’s journey, from the time they receive an email to the message they’re sent. These models are generated from raw customer data such as:

- Account: Outstanding balance, days past due, type of debt

- Behavioural: Previous customer engagements such as email opens, SMS clicks, scrolls on key pages

These are actionable insights that can be used to personalise each specific aspect of the collections experience. Our product, Collect, uses a suite of machine learning models to optimise every customer’s journey:

4. The need to scale quickly and compliantly

Supporting increasing levels of consumers defaulting and improving your operational resiliency means having the ability to scale up. Collections departments without a scalable solution are vulnerable to falling underneath the weight of rising delinquencies, and failing to give consumers the support they need, when they need it.

For most agencies, this requires an increase in their dominant collections channel - voice agents. An over-reliance on call centre operations means any rise in workload can only be managed with more staff, which becomes increasingly challenging in an economic downturn.

The ability to scale quickly, compliantly and with a strong customer experience will be critical as the impacts of economic uncertainty continue to flow into collections. This is becoming an increased focus of the regulators, particularly APRA in Australia, where most banks will be required to have a program in place to comply with CPS230 by 2025.

5. Early AI adopters will be best placed for success

AI dominated our news cycles and newsfeeds in 2023. Every industry is discovering its possibilities, and collections is no exception.

Those who are well placed to leverage this technology are already using AI to create efficiencies across the board. From customer contact to agent training, considered and compliant application of AI holds immeasurable benefits for consumers and collections alike.

- AI interactive voice response (AIVR): integrated voice recognition that identifies the customer, their reason for calling, their sentiment and more

- AI-enabled live call scoring: used to bolster agent training programs and improve quality assurance

- AI voice: mimics human conversation using a combination of natural language processing and machine learning. It can understand and resolve simple queries, enabling teams to support more customers in real time.

As we move the industry into a new era, successful adoption of AI is no longer a future consideration, but today’s reality.

What do our industry experts think?

Here’s what our team is expecting for the year ahead.

1. Privacy protection

Personal data is sold approximately 700x every day in the United States.

Protecting customers in debt in 2024 means securing their information and guaranteeing their privacy. Especially in the United States, where a stronger shift towards robust security measures and the introduction of new regulations is expected.

2. Borderless partnering within booming sectors

The global buy now pay later market was worth $22.86bn in 2022 and is estimated to reach $90.51bn by 2029.

Credit providers will be looking to limit their outsourced partnerships with a focus on streamlining and efficiency. Engaging a sole collections partner who offers scalable, compliant services in multiple markets will be essential to reduce costs and maximise recoveries.

3. AI will be a game changer

Globally, financial institutions were predicted to spend over $10 billion in 2023 to expand their use of AI to improve customer experience and technical processes.

As adoption of AI continues, progressive debt collection agencies will leverage information from customer interactions to enhance their collections practices and improve performance. AI and advanced machine learning will truly set the sophisticated collectors apart from the crowd.

About InDebted

From accessing credit to buying new shoes, today’s consumers opt for transactions that are frictionless and digital-first.

Meanwhile, traditional debt collection hasn’t evolved beyond outdated communication methods and intrusive tactics delivered by agents with the wrong incentives. This results in low collections, poor customer engagement, and significant compliance and reputational risk.

At InDebted, we’re changing the experience of being in debt, by creating a better way for businesses to support consumers through it. Our Collect product delivers up to 40% increased recovery performance, while being the world’s highest rated debt collection solution for customer experience.

Offering the only multi-market compliant and scalable solution for global or enterprise businesses, InDebted is operational in Australia, New Zealand, the United Kingdom, the United States and Canada.

Learn moreReferences

- IDC: Create More Business Value from Your Organizational Data, 2023

- McKinsey and Company, Global Economics Intelligence executive summary, October 2023

- JP Morgan, 2024 economic outlook: 10 considerations for the US economy, December 2023

- Equifax Global Credit Trends, accessed December 2023

- The Wall Street Journal, What the 2008 Financial Crisis Tells Us About Today’s Inflation Surge, 6 April 2022

- McKinsey and Company, The customer mandate to digitize collections strategies, 29 July 2019

- Owl Labs, State of Remote Work 2022, accessed January 2023

- InDebted, Cost of Living Crisis Report, 3 August 2022

- Irish Council for Civil Liberties, The Biggest Data Breach, accessed January 2023

- Fortune Business Insights, Buy-now-Pay-later Market, March 2022

- TransUnion, The Collections Industry in 2022, November 2022

Únase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Únase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Compartir

Otros recursos

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Debt collection industry predictions for 2024

Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.