Navigating the debt collection software tipping point

The secret to developing the perfect debt collection operation? Understanding your tipping point.

Most businesses start out handling outstanding accounts internally, often delegating responsibility to Payments or Finance teams. Graduating to debt collection software seems like a natural next step, right?

Well, not always. Your operating expenses, the cost of collections software and staff time (to name a few) can quickly outweigh any revenue recovered if you’re not careful. Let’s detangle the essentials and where they intersect to help you determine your tipping point.

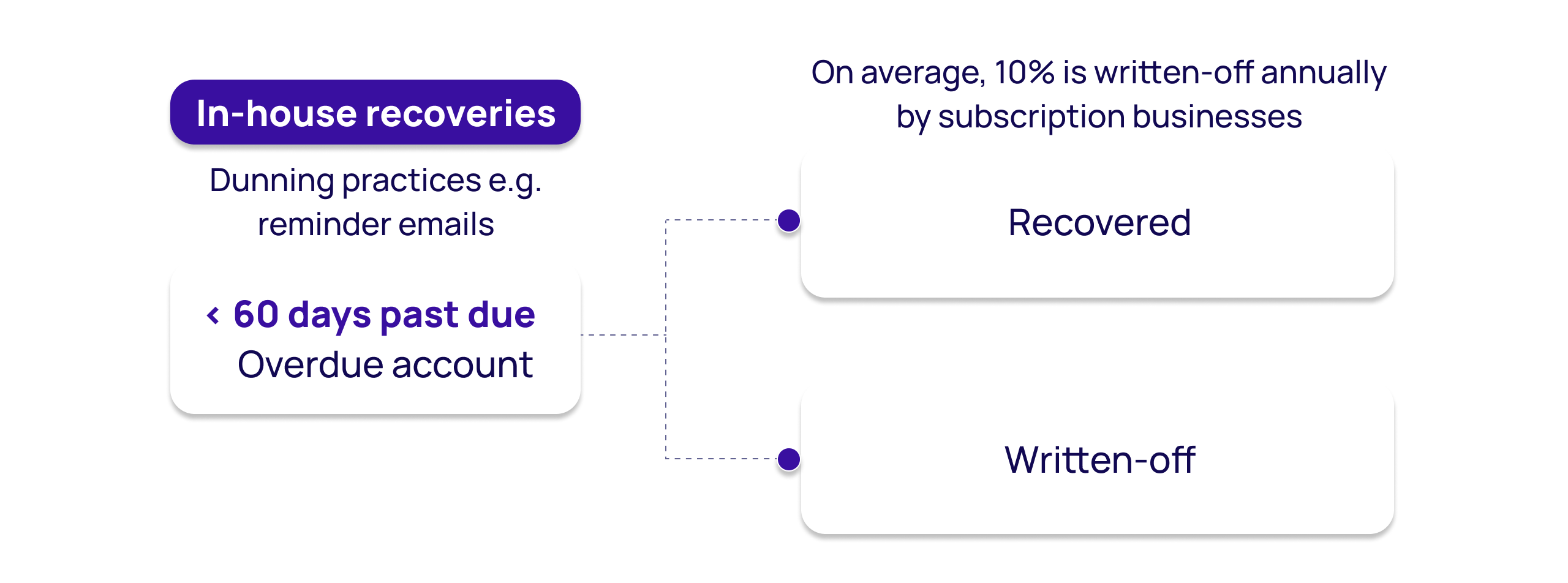

The lifecycle of overdue accounts

Every overdue account has a lifecycle. In the broadest sense, it starts when a customer misses a payment, and ends when that outstanding balance is either recovered, or written-off as bad debt.

In reality, there’s a lot more to it. Between an account becoming overdue and an eventual outcome, it passes through several milestones.

Early stage accounts: Dunning

When an account is less than 60 days overdue, it’s typically serviced in-house. This includes dunning tactics that you probably use today, such as reminder emails or in-app notifications. These early stage accounts tend to be easier to recover, as customers may have simply forgotten to pay or update their bank details.

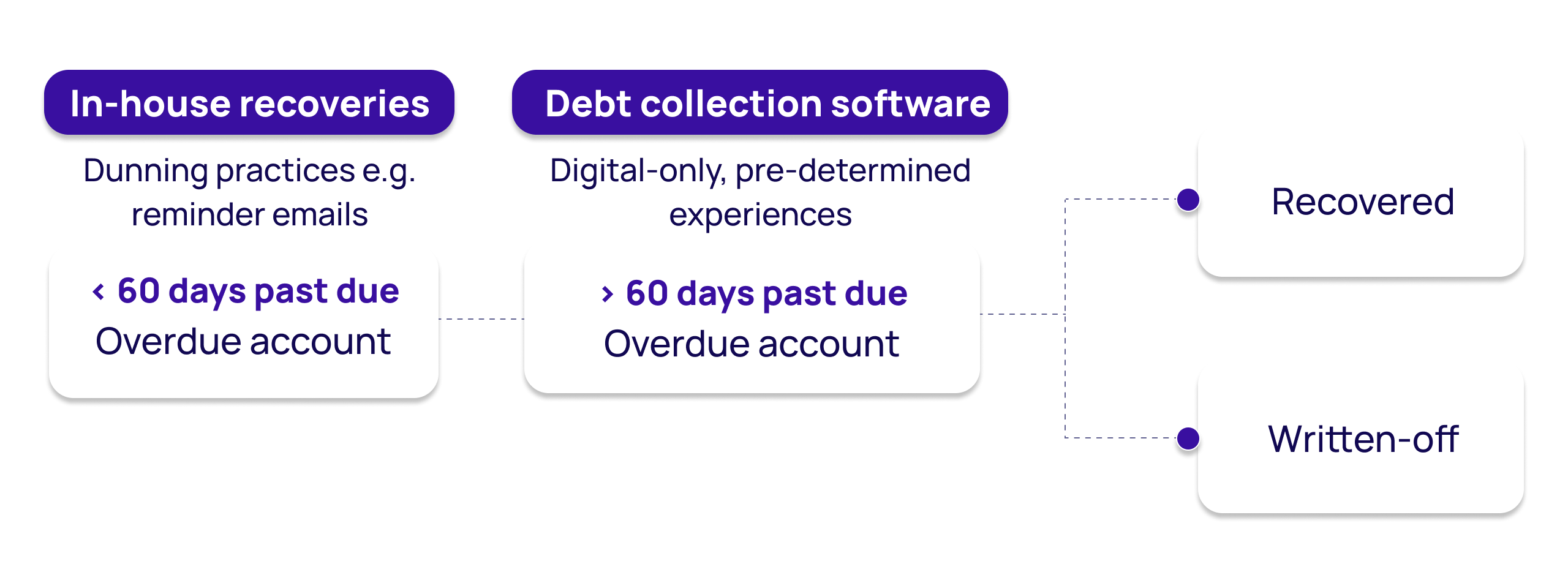

Late stage accounts: Debt collection software or external partners

Here’s where things start becoming more complex. Once an account hits 60 days overdue, some businesses are forced to write-off any outstanding amounts. This can be because it’s too expensive to continue internal efforts, teams have reached capacity, or both. Sound familiar?

A seemingly fitting solution for extending recoveries is automated debt collection software - continuing efforts beyond the 60 day mark while keeping control of your customer experience. Still classed as internal debt collection, at first glance this can initially seem cost-effective as it can be used across your accounts lifecycle. But, debt collection software still requires ongoing maintenance, refinement and Customer Support resourcing (to name a few). These costs can quickly build, outweighing the value of accounts recovered.

In collections, the 60 day point is commonly where we see accounts referred to an agency. This drastically reduces internal workload, as sophisticated collections partners handle all recovery efforts - from communication strategy to Customer Support. The fee structure can vary between agencies, but most such as InDebted are paid on a contingency basis; they claim a percentage of the amount they’re able to recover.

It’s this balance shift that leads many businesses to referring accounts much earlier in their lifecycle, eliminating all internal recovery efforts. In the long-run this allows your teams to focus entirely on your core business, while overdue accounts are being handled by specialists. Take Klarna for example, who eventually wound down all internal recovery efforts early on in their growth. Now, they only use external partners across all their key markets - including InDebted in the United States, Australia, New Zealand and Canada.

The older the debt, the harder it is to recover, right?

One of the common misconceptions is that the older the debt, the harder it is to recover. Now there’s some truth in this. Older accounts have more unique characteristics than newer, more recently overdue balances and agencies typically have lower recovery rates with older accounts. However, results show that personalised strategies coupled with frictionless payment experiences challenge this status quo. For example, we frequently see customers resolve balances that are over 1,000 days old using our online portal.

Where internal debt collection stops making sense: The OpEx tipping point

Up to a point, internal efforts make sense. The problem starts to grow when your outstanding accounts begin to pile up - an unwanted symptom of overall business growth. At this stage, businesses are often faced with the dilemma of choosing between:

- Adding additional headcount internally, to handle the ongoing customer communication

- Licensing automated debt collection software, to help internal teams automate manual processes

- Finding the right collections partner, to manage all recovery efforts externally

Let’s look at how these options can impact your operating expenses, to ensure your collections maintain a net positive return.

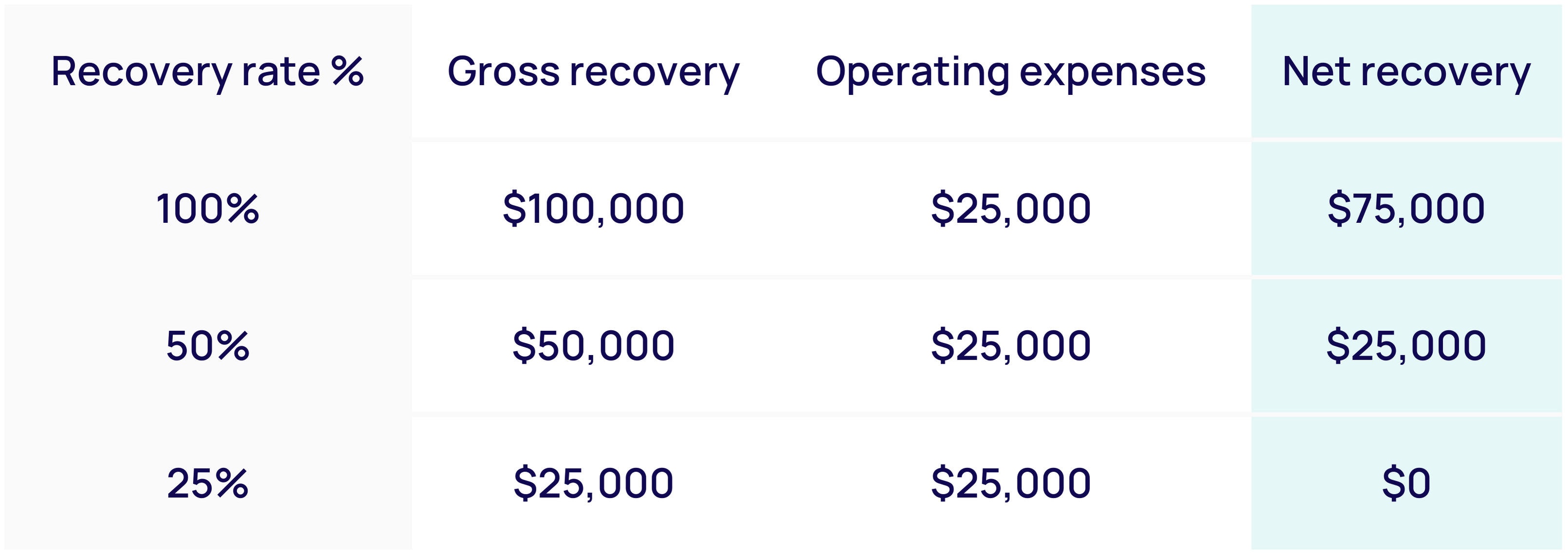

Collections-to-OpEx in practice

Say you have a portfolio of overdue accounts worth $100,000.

Let’s say the cost of servicing them in-house with your Payments team is $25,000, or a debt collection software that costs $30,000.

To calculate your net recovery, subtract your operating expenses from your gross recovery.

Gross Recovery - Operating Expenses = Net Recovery

Across various recovery rates, your net recovery for both options can look quite different.

In-house team:

Debt collection software:

What’s important to bear in mind is that average recovery rates differ, so for example your internal team might have an average rate of 10%, compared to debt collection software that could have a higher average. This number is key as if your recovery rate slips below a certain threshold, you can end up with a net-negative.

With a collections partner, the numbers really start to change. You can cap your internal expenses (no need for additional headcount or software), and leverage their expertise to maximise liquidation. As most collections agencies work on a contingency basis, you’re only charged on a proportion of what’s recovered.

So if you took your $100,000 outstanding portfolio and placed with a partner that has a 20% fee*, your net recovery across different rates would be:

*indicative number for illustrative purposes only

Another factor to consider is that with a partner, your recovery rates tend to be much higher - due to their specialist knowledge and dedicated resources. For many businesses, this is what pushes the OpEx tipping point over the edge.

Internal efforts & debt collection software vs. Collections partner

Beyond the hard numbers, it’s also worth considering the less tangible elements of the collections process. As a business, you have finite resources. Think about your team handling outstanding payments - from engineers and developers, to Finance and Customer Support:

- Is taking care of overdue accounts the best use of their time?

- Is maintaining debt collection software worth the effort?

- Is there something else they could be focused on to grow the business or enhance customer value?

- How will headcount costs change as the business grows? How will this affect our overall operating expenses?

There’s no one answer here. The circumstances vary by industry and by business. But unless collections are a core, vital part of your business, it may be time to start evaluating the benefits of bringing in a collections partner earlier in your accounts lifecycle.

Regardless of when you decide to outsource your accounts, the benefits are ongoing. Especially with more advanced partners such as InDebted, the advantages speak for themselves:

- Cap your expenses with no risk pricing: Unlike debt collection software or additional team members, with a fee-based partner you only pay a portion of the amount that’s recovered - instantly lowering the cost to your business.

- High performance across accounts at all stages: Hand in hand with limiting your expenses, with an experienced, sophisticated partner you can truly reach your recovery potential. For example at InDebted, our omnichannel strategy is delivering up to 40% higher recovery performance when compared to traditional agencies.

- Unlimited scalability across all volumes and regions: Capacity stops becoming an issue with the right collections partner. Take our intelligent collections product, Collect for example. Powered by machine learning and AI, it can handle a sudden influx of accounts in real-time with no impact to performance. In fact, the more customers referred, the smarter it gets.

- Actionable insights that give you a deeper understanding of your customers: Want to know how your customers prefer to interact with their debt? An intelligent collections partner can unlock key insights into your customers, such as what channels they’re most likely to engage with, or how they prefer to resolve their accounts. These findings can strengthen your internal tactics, boosting your performance across more than collections.

- Ever-evolving customer experience that keeps up with expectations: Extending your customer lifetime value is your top priority, and the right collections agency will put this front and centre. At InDebted, this means everything from full self-serve capability and personalised collections experiences, to a five-star Customer Experience team - and everything in between.

The perfect debt collection operation

The main takeaway? Your overdue accounts can make or break your balance sheet.

The cost of ramping up in-house is far greater than most realise, and worth considering carefully before jumping in. Ineffective debt collection can quickly amplify bottlenecks, so keeping your long-term goals in mind is essential. You want to ensure that your collections can scale alongside your business growth - not hinder it. Creating the perfect debt collection setup for your business doesn’t have to mean handling the load on your own, sometimes a helping hand is all you need.

Learn moreÚnase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Únase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Compartir

Otros recursos

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Debt collection industry predictions for 2024

Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.