Debt collection in 2025: trends, technologies and opportunities

What will shape debt collection in 2025?

In 2024, we saw the debt collection industry navigate significant change. Rising delinquency rates, economic uncertainty, and rapid technological evolution reshaped how businesses approach debt recovery. As we look toward 2025, these themes aren’t just persisting — they’re intensifying.

Based on our analysis of key market trends, and supplemented by insights from industry leaders and experts who are actively shaping the future of collections, here are our predictions for how the debt collection industry will evolve in 2025. We hope it’ll help you to plan effectively for the year ahead.

AI technology: from buzzwords to business reality

AI in collections isn’t new, though it’s safe to say it’s been underutilised. 2025 will bring a pivotal shift, where AI adoption becomes standard practice.

A 2023 TransUnion survey showed that while only 11% of debt collection companies were currently using AI/ML-based technology, in total, 60% of them were somewhere along the deployment path to use it, whether they were just considering it or already developing their strategy.

And with good reason. According to McKinsey, organisations implementing advanced AI capabilities in collections are seeing dramatic results:

- 40% reduction in operational expenses

- 10% improvement in recoveries

- 30% increase in customer satisfaction scores

- 30% productivity gains through end-to-end transformation

So what could this look like in practice?

Prediction 1: AI-powered predictive analytics will improve resource allocation

In 2023, organisations that were already on the deployment path for AI and ML cited being able to predict payment outcomes as one of the top uses for the technology. This is very likely to see wider uptake in the coming year; predictive analytics can enable collections teams to prioritise accounts more effectively, focusing on those with the highest likelihood of repayment. This will allow for more strategic allocation of agents to optimise collection efforts and reduce costs.

Prediction 2: AI enhances vulnerability detection

The shift from reactive to preventative support could be one of AI’s most significant impacts in 2025, especially given current economic pressures.

Consider this:

- In the US, consumer debt has reached a record high of US$17.7 trillion (as of Q2, 2024), while pandemic-era savings were fully depleted by March 2024.

- The UK shows similar strain, with nearly half (44%) of adults living in financially vulnerable circumstances — a 16% increase since 2022. Additionally, the number of people with reasonable incomes struggling with high debt levels has risen by 59% to 3.5 million, as 1.3 million who were not previously struggling turn to unsecured loans and Buy Now Pay Later to stay afloat.

- Meanwhile, Australia is seeing unprecedented numbers seeking financial support, despite real incomes stabilising.

Rather than catching consumers after they call out for help, AI can analyse patterns across millions of interactions to identify consumer vulnerability in real time — before they put their hand up (if at all). At InDebted, our solution is already using proactive vulnerability detection. It recognises over 225 high-risk indicators, flagging cases for further investigation.

Using AI for vulnerability detection goes beyond basic rule-following — machine learning models can enhance the detection of subtle indicators of customer vulnerability, predict potential regulatory violations, and automatically adjust communication strategies accordingly.

For example, AI could analyse vocal cues, word choice, and behavioural patterns to identify signs of financial stress or vulnerability. This enhanced detection capability, combined with real-time guidance for agents, can help organisations maintain compliance while providing more empathetic and appropriate support to customers in difficult circumstances.

Prediction 3: Improved quality assurance in agent-customer interactions

While QA automation and optimisation technologies have long been part of the collections landscape, there’s huge potential for AI to take these capabilities to the next level, accelerating processes and reducing the manual workload for QA analysts.

By processing previous call transcripts, chat logs and emails, through to acting as an additional QA layer over real-time communication, AI supports agents to ensure high standards in every single interaction. For instance, flagging language use, tone and readability, while ensuring agents are following processes and procedures to provide key information that accurately responds to the customer’s enquiry.

The result? A more robust QA process where AI augments human judgement. For agents, this translates into faster feedback and real- time coaching, helping them to continuously improve. For managers, it means comprehensive visibility into team performance across all areas of QA, enabling them to identify training needs and optimise customer outcomes proactively. And most importantly: for consumers, this means better interactions that resolve their questions and provide helpful information, creating a trustworthy and reliable experience.

Prediction 4: Wider adoption of voice AI

Talking about debt can be a confronting experience. While the results show that most prefer to self-serve entirely, the role of voice in customer support is still required — whether through custom AI outreach or to fast-track inbound support. For customers who pick up the phone, rigid Interactive Voice Response (IVR) systems where they have to press 1 for yes, or 2 for no simply aren’t meeting modern expectations. However, voice AI offers a more natural and conversational experience, making interactions feel more organic and less automated.

As an example, we ran our first voice AI campaign targeting broken payment plans beginning in July 2023. This involved proactive voice AI outreach to engage customers whose payment plan had failed for any number of reasons, such as insufficient funds or their card expiring.

In the first week alone, 91.9% of successfully contacted customers restarted their payment plan, and 8.1% resolved their entire balance in full — generating $747,226.67 in collections.

What do the experts think?

“As the debt collection industry approaches 2025, the most valuable AI investments will be those that prioritise transparency, personalisation, and proactive engagement. These are the areas that will drive meaningful, trust-building interactions with customers, transforming the perception of the industry while also streamlining processes.”

— Jo Mikleus, Non-Executive Director at Avenue Bank and Acumentis Group

“The real innovation isn’t in offering AI as a bolt-on feature — it’s in how you integrate it into your strategy. Effective AI solutions enhance human decision-making, such as being able to identify what level of intervention is needed, and when, for each customer; automating time-consuming tasks like data collection and analysis, and supporting agents with real-time QA during customer conversations.”

— Hugo Rajotte, VP of Global Growth, InDebted

Industry consolidation: scale becomes critical

While the collections industry is no stranger to M&A activity, expect to see more over the next 12 months. Markets such as the United States, United Kingdom and Australia have already seen multiple key transactions and significant industry consolidation in recent years, and this is set to increase.

Technology investment requirements

Organisations are facing substantial pressure to invest in AI, machine learning, and digital infrastructure. Not all players will have the capital or expertise to make these investments, leading smaller agencies to seek strategic partnerships or exit opportunities.

Operational complexity

As regulatory requirements become more stringent and consumer expectations evolve, the operational burden on collection agencies continues to grow. Larger organisations with sophisticated compliance frameworks and established digital capabilities will be better positioned to manage these challenges.

Economic headwinds

The economic environment is reshaping the industry’s workforce dynamics, due to rising labour costs and recruitment challenges. Collection leaders are facing heavy pressure to improve operating margins by taking on more accounts while driving down costs. Inevitably, consolidation continues to be the solution for many agencies to improve profitability. Other firms are simply closing their doors. The message is clear: adapt, or risk being left behind.

The result? We expect to see:

Prediction 5: Increased M&A activity among small and mid-sized firms

In 2022, debt collectors anticipated moderate increases in employee compensation, technology costs, and postage expenses over the following two years. While most companies maintain confidence in their financial positions, the story changes drastically by company size: larger debt collection companies are far more likely to be optimistic about their financial future than their smaller counterparts.

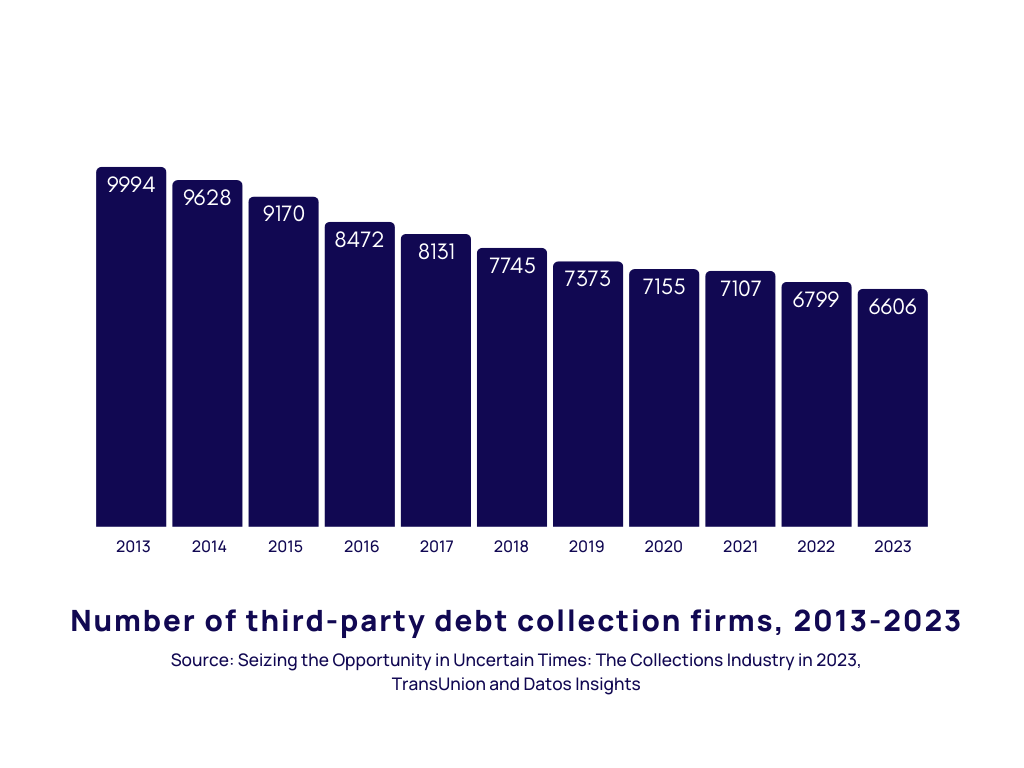

This size-based divide is particularly significant given the industry’s composition. In the US, approximately 73% of debt collection firms employ fewer than five employees. The industry is already experiencing consolidation, with the number of third-party collection firms declining 2.8% to 6,606 in 2023. This trend appears set to continue, with the Bureau of Labor Statistics projecting a 9% decline in jobs by 2033.

To add to that, in a 2023 survey, 64% of third-party debt collection firms agreed that their businesses must diversify — such as through collecting different types of debt, or expanding into other geographic regions — if they’re to succeed, thrive or survive in the long term. All these factors combined point to increased M&A activity in the collections industry, with agencies of varying sizes being acquired for access into different debt portfolios or geographic regions.

What do the experts think?

“The debt collection industry is primed for consolidation. We’re seeing multiple forces converge: rising regulatory complexity that demands sophisticated compliance systems, technological efficiency investment to create natural economies of scale, and evolving consumer expectations that favour agencies with modern capabilities. Current market conditions actually favour strategic acquisitions — particularly for well-capitalised firms looking to further their market share or tap into new product lines."

— Josh Foreman, CEO & Founder, InDebted

Prediction 6: Rise of debt collectors with niche sector specialities

As debt portfolios become more complex, we expect to see the emergence of collection agencies that specialise in specific sectors.

Take the Buy Now Pay Later (BNPL) sector, for example. Globally, it’s expected to grow at a CAGR of 20.2%, reaching $160.2 billion by 2032. Clearly, consumer demand for paying in instalments is only going to increase.

But BNPL debt presents unique challenges. Unlike traditional credit products, BNPL debt may not appear on credit reports, creating an “invisible” debt burden that requires specialised approaches to manage. With new regulations on the horizon in markets like the US, UK, Australia, and more, collection agencies handling BNPL debt will need, at a minimum:

- A deep understanding of BNPL regulatory requirements in different markets

- The ability to handle high-volume, low-balance accounts efficiently and at scale

- Expertise in digital-first collection strategies that align with BNPL users’ preferences

This trend toward specialisation isn’t limited to BNPL. We expect to see similar expertise-focused agencies emerge in other niche sectors where regulatory complexity, customer behaviour, and account characteristics require specialised approaches.

What do the experts think?

“As financial products become more specialised and regulations more complex, I believe we’ll see a clear shift toward sector-specific collection strategies. Take BNPL, for instance. These aren’t traditional credit products, and they can’t be treated as such. Success requires a deep understanding of the sector’s unique characteristics: its regulatory framework, consumer behaviours, and operational demands.

What we’re really talking about is the evolution from generalist to specialist collections. Companies that can combine deep sector expertise with digital capabilities and regulatory compliance will be the ones that thrive in 2025 and beyond."

— Laura White, Chief Risk and Compliance Officer, InDebted

Data privacy and cybersecurity: advanced capabilities are the new baseline

The debt collection industry is entering a new era of data protection where traditional security measures are no longer sufficient.

Collection operations are becoming increasingly digital and AI-driven, which increases the complexity of managing sensitive financial data across automated workflows and multiple channels. Meanwhile, the cost of data breaches is rising, and the associated reputational damage is not something that companies can afford in 2025.

This means taking advanced measures to protect consumer data is no longer optional — it’s simply table stakes.

Prediction 7: Data security capabilities must evolve along with technological advancements

While robust data security is already a baseline requirement for collection agencies, 2025 will see these standards evolve significantly to match technological advancement. As AI adoption accelerates and data flows become more complex, yesterday’s best practices will become tomorrow’s minimum requirements.

Collection leaders will need to demonstrate increasingly sophisticated approaches to data protection, including enhanced data sovereignty controls and privacy-preserving techniques. Organisations that fail to evolve beyond current security standards risk falling behind, as security requirements become more stringent to match the complexity of modern collection operations.

What do the experts think?

“We’ll see privacy-preserving AI techniques like federated learning and differential privacy become standard practice. These approaches let us tap into the power of AI without exposing sensitive data, ensuring we can personalise experiences while staying compliant and secure.

I also expect zero-trust architecture to evolve. In collections, that means continuously verifying every transaction, user, and access point. With sensitive data at stake, this layered security approach is very important as more automation and AI are integrated into workflows.

The focus on data sovereignty and localisation will intensify. Collection companies will need sophisticated data governance frameworks to handle privacy regulations across different regions, while maintaining operational efficiency and high performance.”

— Pierre Bergamin, CTO, InDebted

“When I was evaluating DCAs as a creditor, robust data security wasn’t just about compliance — it was about trust. Today, data security audits are standard prerequisites in RFP processes, but in 2025, the bar will be even higher. Partners will need to demonstrate sophisticated data governance, transparent processing protocols, and consistent security excellence. For existing panel members, regular security assessments won’t just influence contract renewals — they’ll determine them.”

—

Charles Allen, Strategic Client Success Manager, InDebted

The future of customer experience: technology with a human touch

Traditional collection tactics are showing their age. Collection departments that remain heavily reliant on call centres are struggling to meet modern consumer expectations while maintaining operational efficiency.

But the future of collections isn’t about replacing traditional methods entirely. The challenge — and opportunity — lies in how technology such as AI, combined with human expertise can work together to enhance customer experience and improve outcomes. The most effective collection strategies meet customers where they are, when they’re ready to engage, through seamlessly integrated touchpoints.

Prediction 8: Seamless, hybrid engagement strategies will see the most success

In 2025, collection leaders will focus more closely on mastering the balance between digital efficiency and human empathy.

The most successful approaches will use digital innovation to uplift traditional methods, delivering higher performance at lower costs. Routine interactions can be efficiently handled through digital self-service portals or conversational AI. But when it comes to complex cases, human intervention will continue to be vital.

This also means going beyond simply offering multiple communication channels. Instead, the highest-performing teams will be those who offer omnichannel collections — creating truly frictionless experiences that give customers control over how they engage.

Prediction 9: Regulatory focus will shape the pace of customer experience innovation

The evolving regulatory landscape is creating a complex environment for customer experience innovation in collections. While the potential benefits of new technologies are clear, the path to implementation requires careful consideration.

This was evident at the 2024 Credit & Collections Think Tank conference in the UK. Some professionals expressed hesitation about implementing AI, concerned about potential retroactive regulatory liability. Others viewed regulation not as a barrier to innovation, but as a framework for creating sustainable customer experience improvements.

Looking ahead to 2025, collections leaders face a critical balancing act. The pressure to innovate and deliver modern customer experiences remains strong, but execution must be thoughtful and measured. To succeed, organisations will need to find ways to advance customer experience initiatives while ensuring they meet both current and potential future regulatory requirements.

What do the experts think?

“Some of the regulatory changes we’re seeing in the UK have been incredibly positive, particularly the focus on customer outcomes. Whether more directional or prescriptive in nature, these regulations are genuinely pushing our industry to raise standards and work to a higher quality. The destination is clear — better outcomes for consumers — but the journey there is complex. Success in 2025 will depend on how well organisations navigate the practical challenges of implementation: the detailed processes required, the data that needs to be captured and analysed, and the operational changes needed to deliver consistently better customer support.”

— Chris Warburton, Director, ROstrategy

“As the CFPB has pointed out, in the US, collections is one of the few industries in which a customer is unable to ‘vote with their feet.’ Since customers can’t choose their debt collector, there’s been little incentive to invest in customer experience innovation. Collectors compete with one another for clients and accounts, but not for customer attention. However, as economic pressures drive up collection volumes across all paper types, I believe there’s a strong opportunity for customer experience to become a crucial differentiator.

When customers are being contacted by multiple collectors through multiple channels, standing out matters more than ever. InDebted’s digital-first approach across multiple markets enables us to provide a consistent, streamlined experience, and I’m excited about the product improvements and innovations we have planned in 2025 to continue to enhance the CX for customers in collections.”

— Kristyn Leffler, Chief Product Officer, InDebted

Time to act: preparing your collections strategy for 2025

The year ahead is an exciting one for the collections landscape. While our industry has traditionally been slow to change, 2025 will be a year of decisive action — and opportunity. Success will come from striking the right balance: embracing innovation while maintaining human expertise, ensuring compliance while driving efficiency.

These predictions are your starting point. Whether you’re taking your first steps toward modernising your collections strategy or accelerating existing initiatives, the time to act is now. Your reward? Stronger performance and happier customers.

Ready to see what a modern, intelligent debt collection partner can do for your business?

Talk to our teamÚnase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Únase a nuestro boletín para conocer las últimas novedades sobre colecciones

Thank you for subscribing!

Compartir

Otros recursos

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Debt collection industry predictions for 2024

Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.