Introduction to InDebted and what we do

Consumer expectations have changed, debt collection hasn’t.

From accessing credit to buying new shoes, today’s transactions are frictionless and digital-first.

That said, hundreds of millions of people around the world are faced with a debt collection industry that’s known for outdated communication methods, intrusive tactics, and shaming people who have fallen behind.

In the face of economic uncertainty, increased inflation and the rising cost of living, it’s all too easy to become financially overextended. And when life changes overnight due to work, family, or health, falling behind on payments or missing an overdue bill can happen to anyone, at anytime.

Nobody can change the fact that debt happens - but we can change the experience of being in debt, by creating a better way for businesses to support their customers to get back on track.

Part one: Why consumers need a new way forward in debt collection

Consumer behaviour has evolved at an amplified rate, especially since the pandemic. The key shift? Convenience. Research published by Deloitte in 2022 highlighted that 78% of consumers value convenience even more since COVID-19, but not at the expense of choice. They advocate for an omnichannel experience to put the customer firmly in the driving seat.

The way we conduct financial services has changed - digital banking, virtual appointments, and contactless payments are just some examples of how both emerging and key players have modernised their offering. Businesses that thrive in this landscape enable convenience by being accessible to customers through their preferred channel.

When we look at the collections industry, consumer expectations and behaviours have rapidly outgrown dated practices. Repetitive phone calls, letters in the post, and aggressive messaging are tactics that are still used today by large collection agencies (Transunion found that in 2022, 90% of collectors use phone and letters as their primary communication tools), despite being associated with consistent short and long-term negative outcomes.

Most agencies recognise the disconnect between modern consumer expectations and traditional recovery methods, but find bridging the gap a complex challenge. And so, we’ve seen collectors taping over these cracks, taking micro steps towards modernisation like the introduction of using email as a channel for sending collections communications. Unfortunately, this does little to keep up with who consumers are today, let alone anticipate or exceed their expectations. And these small steps are often poorly executed, with little use of data to drive performance, insufficient knowledge of best practice under regulatory frameworks, and still with the same pressuring or poorly written messaging.

How do current debt collection practices fall short?

Traditional debt collection

Standard forms of debt collection offered by industry incumbents can be rooted in inherently harmful practices that generate minimal returns and poor consumer outcomes. Heavily reliant on contact centres full of agents using an automated dialler, there’s compliance risks, greater operational costs and little to no scalability. Going down the traditional collections route is far more likely to create a negative experience for your customers, with real consequences like damaging your company’s reputation, experiencing high complaints, and burning your valuable customer relationships.

Digital debt collection

In more recent years, we’ve seen the rise of digital debt collection. Typically, this involves communicating with customers via channels like email or text message to encourage them to engage with their debt.

Many agencies market themselves as digital debt collectors, when in reality, it’s an inefficient bolt-on to their existing collections operations. Consumer expectations have developed at a faster rate than collectors can keep up with, and while it’s a step in the right direction, simply sending emails instead of letters fails to meet them. Emails are sent to customer lists as part of mass campaigns, where every customer gets the same email, at the same time of day, under a one size fits all strategy. This cookie cutter approach means that all emails or text messages sent include the same wording and the same call to action. There’s little to no personalisation, and their poor internet domain reputation often means emails will land straight into the spam or junk folder.

Collections providers using digital channels are also often reliant on purchasing expensive tech stacks to incorporate digital channels into their existing call centre operations. From these tools, there’s a basic level of analytics to determine performance metrics like the engagement and open rates, which are rarely applied to generate true data-informed decision making.

True to the term ‘digital’, one benefit is these agencies will often have a self-serve component like a debt management portal or website where customers can pay in full. On first glance, this offers customers some repayment options, but in practice these portals can be inflexible. If a customer wants to set up or modify their plan, they will normally have to speak to a collections agent over the phone - falling short of the self-serve label.

The bottom line is - digital collections rarely unlocks the true power of technology, and is still reliant on the decision making of the people who hit send, rather than leveraging real machine learning and data intelligence to power true recovery performance.

Part two: What is intelligent debt collection, and how does it work?

What do we mean when we talk about “intelligent debt collection?”

Intelligent debt collection represents an advancement in the general ethos behind how debt collection should be practised, and the sophisticated technology that drives it.

It starts with a mindset shift towards how people in debt should be treated and engaged with. It puts the power back in their hands - rather than being pressuring or harassing, it’s intuitive to how people prefer to manage their debt, creating empowered customers who pay it back faster, proactively, and more sustainably.

We created the term, as it’s synonymous with our intelligent debt collection product, Collect. Being product-led means that the technology behind how we collect is entirely owned by InDebted, as it’s built internally by our engineering and data teams. The advanced use of data science, omnichannel communication, and an industry-disrupting approach to customer experience opens the door to possibilities unachievable by either traditional or digital collections.

This makes way for the industry’s highest customer engagement rate of 5-7%. From the ongoing investment in new product features, to how data science such as machine learning is applied; clients using intelligent debt collection maximise their ability to recover overdue accounts, while supporting their customers and protecting their reputation.

How data science and machine learning differentiates collections intelligence

The ‘secret sauce’ in intelligent debt collection is its use of data science. Let’s start with the basics.

Data science: The practice of using data to create actionable insights and implement intelligent processes.

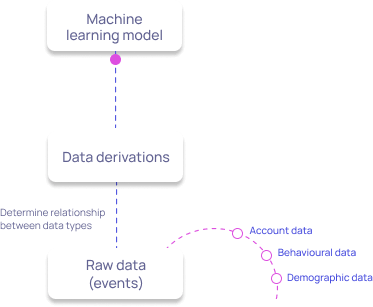

Machine learning: A form of data science, where algorithms are deployed to learn from data derivations, and the learnings are used to generate inferences for future use.

Behavioural data: Each interaction we have with our customer is recorded in our data warehouse. This may include data points which we can learn from, for example, when an email is opened by a customer following a particular message.

Data derivations: In the context at InDebted, this refers to the relationship between behavioural data and other account data, for example the propensity of a customer to be engaged given the following: email opened + time opened + debt type + customer age.

How machine learning models are generated

Machine learning models are created using raw customer data such as:

- Account: Outstanding balance, days past due, type of debt

- Behavioural: Previous customer engagements such as email opens, SMS clicks, scrolls on key pages

Once the model has received the raw data, it processes the information to determine the relationships between the different data types. This information processing produces data derivations which are actionable insights that can be fed directly into Collect.

Machine learning model in practice: Message scheduler model

This particular machine learning model uses data derivations which predict the optimal email send time according to the specific characteristics and behaviours of an individual customer.

Once the model has assessed the profile and behaviour of an individual customer and produced an optimal send time, it simply feeds this information directly into our intelligent debt collection product. Collect will then automatically contact the customer at their personalised email send times, optimising the likelihood of conversion for every message sent. This seamless integration between our machine learning models and Collect means that utilising data insights is effortless; establishing automated intelligence.

InDebted’s expanding data warehouse

The data used to inform our machine learning models comes from InDebted’s data warehouse, which currently houses more than 300 million customer engagement events. All data derivations produced are unique and owned by InDebted, as they incorporate historical data from millions of customers worldwide.

This growing data bank ensures that all models developed by InDebted are informed by real behaviours of customers in debt. Most importantly, due to the very nature of data science, as more customers are referred to Collect, the models are continuously shaped by new data and learn to produce even more precise recommendations.

How machine learning models are generated at InDebted

How collections intelligence creates an intuitive, entirely individual customer journey

Exceeding customer expectations is the ultimate goal for most businesses - particularly within sectors such as BNPL whose business models are strengthened by the ability to secure repeat customers. As intelligent debt collection is rooted in data science, it not only exceeds preferences, but anticipates them.

The use of machine learning models means that every collection communication is informed by the customers’ interaction with the last, as well as their demographic and other behavioural characteristics. So when we look at an end-to-end customer journey, each will be personalised and bespoke to who that individual is, and how they want to engage with their debt.

The case for omnichannel

Core to delivering an intuitive journey is omnichannel communications. Across many industries, we’ve seen a rise in omnichannel offerings - in 2022 it was noted that omnichannel shopping is becoming the norm for 3 in 4 US consumers. The collections industry should be no exception.

A 2019 McKinsey & Company study showed that across high and low balances, credit card customers prefer to resolve their debt using digital channels, not traditional methods like phone calls. This was highest for 30 DPD, where 23% more customers made partial or full payments digitally. However, they also identified the following subset who prefer traditional contact:

- Larger balances

- 44 years-old and above

- Pay their balance in full

- Have never used their account digitally or via an app

Digital channels are key to meeting today’s consumer expectations and enabling convenience, but collection providers need to be truly responsive to the channels people prefer across different demographics and behaviours. While collections intelligence embodies a digital-first approach, not to be mistaken with digital only, its intuitive nature means that voice channels are still open to customers. It’s about providing choice for customers to engage with their debt in a way that works best for them, through two way communication across:

- Voice

- Self-serve portal

- SMS

- Webchat

Customer support team

While the self-service rate for InDebted customers has increased across the UK, US, NZ, Australia and Canada (peaking at 91% in the US), approximately 1 in 5 customers will reach out to our Customer support team. Interestingly, the highest proportion (22%) of such interactions are customers who pay their balance in full.

InDebted’s Customer Support team are unlike traditional collection agents. Traditionally, agents have been rewarded on dollars collected which can often lead to misaligned incentives and the development of harmful practices. The customer-centric approach taken in developing Collect, is mirrored in our Customer Support team. Every team member is rewarded based on consumer outcomes, measured by five-star Google reviews left by customers. Over time, this has accumulated to over 2,000 five-star reviews, making InDebted the highest customer-rated debt collector globally.

Digital: Self-serve customer portal

The debt management web App enables customers with the autonomy to resolve accounts on their own terms. On average, 4 in 5 customers referred to Collect opt to self-serve entirely using the App, demonstrating the overwhelming preference for digital-first convenience.

Once logged in, they’re provided with a multitude of payment options, including paying in full, tailored payment plans, direct client payments or further support. This fosters an intuitive end-to-end journey for every single individual:

Part three: How intelligent collections supports businesses

Where debt collection has been viewed by many businesses as a necessary but often limited revenue stream, intelligent collections has broader potential to influence multiple areas such as strategy, compliance and product.

Infinite scalability to support large customer volumes, in real time

A debt collectors’ capacity to collect is traditionally reliant on agent headcount and rostered hours in call centres. At a time where delinquencies are increasing and the impact of economic downturn is being felt globally, an influx in overdue accounts is a challenge for agencies and internal teams to handle - without having to make significant increases to headcount and shifting their operations.

In stark contrast, an intelligent collections solution can handle an influx in accounts in real-time, without hiring additional staff. As a digital-first model, customers are engaged automatically once they are referred into the product. Perhaps even more impressive is the model’s cyclical learning, as the more customers our collections product engages with, the more accurate the data science becomes. Coupled with a stable investment into the product’s development, an intelligent collections solution offers both greater efficiencies and longevity for credit providers.

Compliance protection for your business and your customers, globally

Financial services is a highly regulated industry, and debt collection is no exception. The added complexity of state, region and country specific compliance regulations, licensing and information security standards makes collecting on a global scale a minefield. For collectors reliant on agents to follow regulatory guidelines, staying compliant becomes even more complex simply due to risk of human error. This presents itself through negative online reviews, high levels of IDR & EDR complaints and even the intervention of regulatory bodies, all of which bring consequences to the clients these collections agencies represent.

On the other hand, intelligent debt collection has multi-market compliance built in. Our proprietary compliance firewall reinforces local regulations by code, ensuring all collections activity is consistent with relevant regulations and consumer protection laws. This is layered with licensing to collect debt within all operational markets, plus data security protection to the highest global standards such as SOC2, ISO27001, ISO9001 and PCI. The ever-changing nature of regulations is also taken into account, as a team of Compliance and Security experts constantly scan guidance worldwide to ensure that Collect’s code remains updated in real time.

Taking this even further, the borderless nature of Collect means it can expand with businesses into multiple markets worldwide. This prevents the need to vet and secure multiple partners for different locations, allowing for a streamlined and unified approach to recoveries. It ensures consistent protection and a personalised experience for your customers, regardless of where they’re located.

Collections insights to drive business strategy

In a constantly evolving landscape, businesses around the world are seeking new ways to drive revenue and enhance their understanding of customers. Collections analytics have typically been overlooked in this respect, as traditional collections practices fail to offer further insight beyond total amounts collected. Whilst this provides some value, it barely scratches the surface on exploring who customers are, how they interact with their debt, or what channels they prefer to engage with (to name a few).

Collections intelligence enables clients to understand their customers on a far deeper level, from a holistic perspective as well as through to the granular detail. Where there’s often more distance between traditional third party collections and clients, intelligent collections views the relationship as a true partnership. Your teams can be equipped with a superior understanding of your consumer base, ensuring your business stays proactive in planning for the future, whilst holding a stronger position to be responsive to changing customer needs. In a challenging macroeconomic environment, the value of applying real customer insights can’t be underestimated.

How collections intelligence supercharges your recoveries backbone

Market-tested superior liquidation

When compared to traditional collections, Collect delivers up to 40% improved liquidation rates. This has been demonstrated across all debt types and demographics.

The world’s largest data collections warehouse

InDebted has been recovering accounts for over five years, accumulating insights from millions of customers worldwide. This has resulted in the world’s largest collections data warehouse, which continues to grow in real-time.

The industry’s best customer experience

Over 2,300 customers have rated their experience with InDebted 5-stars on Google, making us the highest rated debt collector globally.

Secure scalability for growing businesses

As product-led, you can infinitely scale with Collect without any impact on performance rates. In fact, the more customer data transmitted into Collect, the smarter it becomes.

Improve compliance, reduce risk and limit human error

All compliance requirements are built in for every jurisdiction by code. Our clients have peace of mind knowing that regardless of region, all collections activity is regulated with all current laws.

About InDebted

Customer expectations have changed.

Traditional debt collection hasn’t.

It’s outdated and impersonal, and delivered by agents with the wrong incentives. The result is low collections performance, poor customer engagement, with compliance and reputational risk.

At InDebted, we’re changing the world of consumer debt recovery for good, by creating a better way for businesses to support their customers through it.

Our Collect product delivers up to 40% increased recovery performance, while being the world’s highest rated debt collection solution for customer experience.

We put the power back in the customer’s hands - rather than pressuring or taking an impersonal approach, our product is intuitive to how people prefer to manage their debt. This creates empowered customers who get back on track faster, proactively, and more sustainably.

Offering the only multi-market and scalable solution for global or enterprise businesses, InDebted is operational in the United States, Canada, the United Kingdom, Australia, and New Zealand.

Book a demoRejoignez notre newsletter pour les dernières informations sur les collections

Thank you for subscribing!

Rejoignez notre newsletter pour les dernières informations sur les collections

Thank you for subscribing!

Partager

Autres ressources

Debt collection in 2025: trends, technologies and opportunities

Key predictions and expert insights on where the collections industry is headed in 2025.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Debt collection industry predictions for 2024

Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.