How we use machine learning to create 20% higher email payment conversion rates

Ensuring that an email reaches your customer’s inbox at the perfect time is essential to optimising open rates, and driving higher payment conversions. To find the perfect time to send customers collections emails that prompt them to take action and start their recoveries journey, InDebted has launched a new machine learning model. Our message scheduler model harnesses the power of customer engagement data to provide personalised recommendations on the best time to send emails, ensuring they don’t remain ‘unread’ and balances don’t remain unresolved.

When it comes to email conversions, timing is everything

To understand the correlation between sent time, open rate and conversion rates, we analysed the performance of 2.4 million customer email communications over 3 days. The data showed that emails opened by customers within 30 minutes of being delivered had a higher click through and conversion rate than emails opened up to two days after being delivered. Appreciating the correlation between these key success factors means that optimising the time an email lands in a customer’s inbox improves the click rate. More clicks means more conversions and ultimately greater, faster recoveries.

Using data science to generate personalised email timings

This tells us that customer convenience is everything. Hitting send on mass email campaigns isn’t enough - each communication needs to be tailored to each individual customers’ preferences in order to see superior recovery performance. And so, our new message scheduler machine learning model is continually learning from different types of historical customer engagement data to inform when to send emails at a time that works best for each customer. The types of data used include:

- Account: Outstanding balance, days past due, type of debt

- Behavioural: Previous customer engagements such as email opens, SMS clicks, scrolls on key pages, and clicks in our customer portal

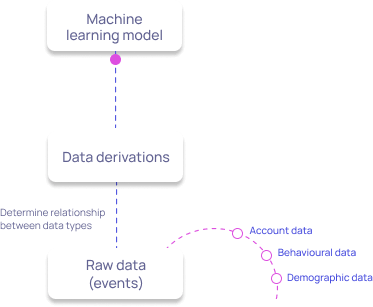

Once the model has received the raw data, it processes the information to determine the relationships between the different data types. This produces data derivations which predict the optimal email send time according to the specific characteristics and behaviours of an individual customer. These data derivations are unique and owned by InDebted, as they incorporate historical data from millions of customers. Due to the nature of data science, as more customers are referred to InDebted’s product, the model will continually learn and produce even more precise recommendations.

The data used to inform our machine learning models comes from InDebted’s data warehouse, which currently houses more than 1 billion customer engagement events. This growing data bank ensures that all models developed by InDebted are informed by the real behaviours of customers in debt, including the email scheduling model. After the model has assessed the profile and behaviour of an individual customer and produced an optimal send time, it simply feeds this information directly into our intelligent debt collection product. The product will then automatically contact the customer at their personalised email send times, optimising the likelihood of conversion for every message sent. This seamless integration between our machine learning models and our Collect product means that utilising our data insights is effortless; establishing automated intelligence.

How machine learning models are generated at InDebted

Increasing conversions by 20%

The first generation of the message scheduler was launched in October 2022, and customers contacted based on the model’s timing recommendations had an initial increased conversion rate of up to 15%, compared to customers who were contacted at random. Interestingly, when the impact was analysed, links were also found between the increased conversion rate and the type or amount of debt.

After the launch of the first version, further improvements were made to develop the second generation of the model. This second version was released in November 2022 and has resulted in a further 5% increase in conversion rates resulting in an overall increase of up to 20%. The ongoing, long-term benefit of the model is that it will continue to learn and develop from our expanding data warehouse to become even more intelligent.

Get a demoRejoignez notre newsletter pour les dernières informations sur les collections

Thank you for subscribing!

Rejoignez notre newsletter pour les dernières informations sur les collections

Thank you for subscribing!

Partager

Autres ressources

How we use machine learning to create 20% higher email payment conversion rates

Read about our latest machine learning model, the message scheduler and how it makes sure emails land at the perfect timeWe asked real people in debt what they wanted from a debt collector

Read what real customers want from debt collectors and how we’re taking it forwardAccess visibility into your customers accounts’ performance with our new Portal feature

Read about our latest client feature and how it enables real-time access into how accounts are performing, and moreView InDebted’s commitment to security with our Vanta trust report

Access InDebted’s Vanta trust report to see how we keep your business and customers safe