The ins and outs of our Product Roadmap

“It’s not about adapting to change, it’s about creating it.” - Pierre Bergamin, Chief Technology Officer, InDebted.

In our recent Product Roadmap live showcase, our CEO & Founder Josh Foreman sat down with InDebted’s Chief Technology Officer, Pierre Bergamin, Chief Data Officer, Mike Zhou and Chief Risk Officer Laura White to share our 2024 Product Roadmap.

Our team gave an inside look into the technology that powers collections intelligence, including upcoming features, and an exclusive demo of our latest development, the AI Collector in Beta.

Here’s a breakdown of what’s on the roadmap for our product, Collect:

1. Engagement intelligence

Personalised communication sets intelligent debt collection apart, and this year it’s going to get even better.

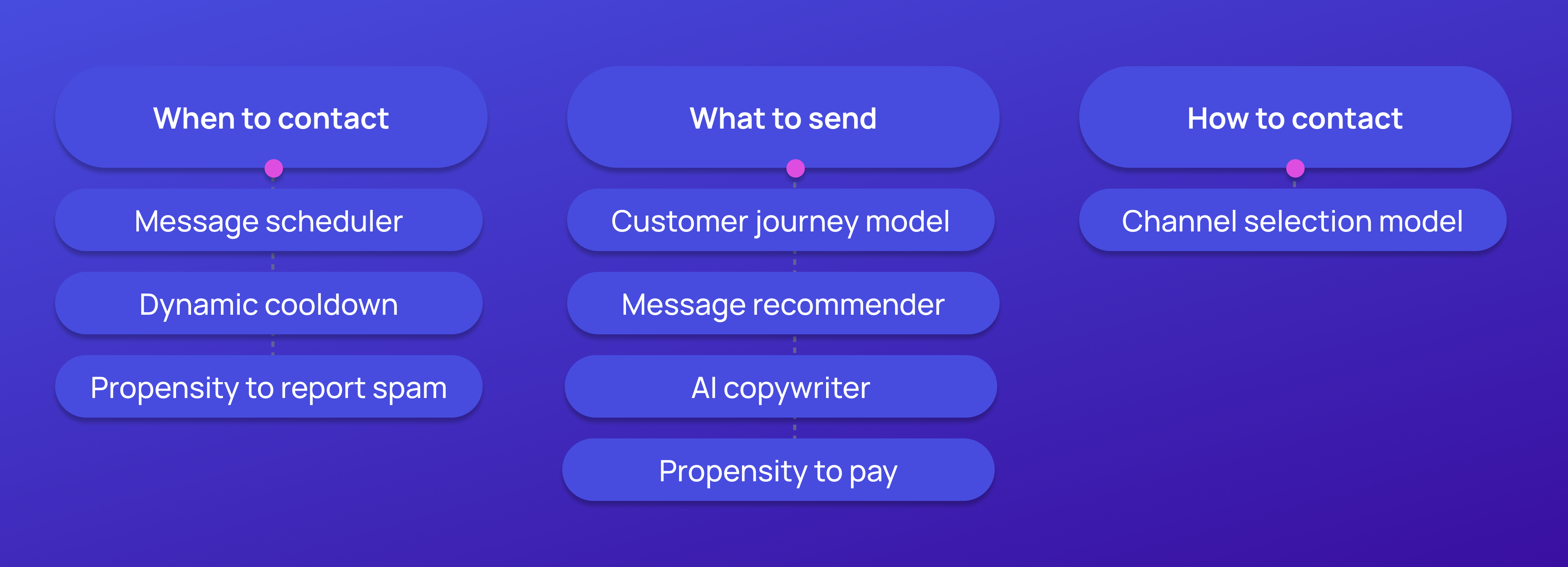

Our Collect product uses machine learning models to create an individualised customer journey. Each model personalises a specific point of the collections journey. For example, our message scheduler model determines the best time to communicate with a customer based on their individual preferences and behaviours. Our models work in sync under three broad areas to create a unique collections experience that’s tailored to each person:

This year, we’ll invest further into each of our models individually to maximise their capabilities. Pierre also shared that there’s also new models on the horizon to further enhance engagement and delivery across all channels, such as a model to minimise email spam rates to improve overall delivery.

The collective impact of fine tuning our entire machine learning model portfolio will be game changing, creating a collections journey that’s even more intuitive to how each individual customer wants to interact with their debt.

2. Introducing our AI Collector

In 2023 we kicked off our AI journey with the launch of our AI copywriter and AI voice. The impact of these features so far has been significant. If we take our AI copywriter for example, which uses large language model technology to write outgoing email and SMS communications, we’ve seen conversion rates increase by 32% since its launch.

The AI Collector is the next step. It’s our conversational response AI that automatically handles inbound customer email inquiries. It uses language models to:

- Answer customer support requests for example payment or balance queries

- Provide compliant responses that are in line with the regulatory requirements of where a customer is located

- Update account information in real-time

- Escalate sensitive matters to our Customer Experience team such as hardship situations

Currently live in Beta with one of our largest Australian clients, the AI Collector is already improving efficiency and customer experience. During the Product Roadmap showcase, Mike explained that its flexible infrastructure is customisable for different client needs, which means that Customer Service agents can enhance the AI Collector’s capabilities themselves - without the need for technical programming skills.

This year, we’ll build on its existing technology to expand the range of topics it can support customers with. In the long run, this frees up our Customer Experience team members to focus on more complex cases. We also plan to launch the Collector in other markets, once we’re confident that it meets regulatory requirements in more complex regions such as the United States.

3. Security & compliance

Continued investment in security and compliance goes hand in hand with the development of new technology. This includes:

- Additions to our Compliance team to increase our capacity

- New practices to ensure our product stays ahead of the latest cyber security trends and regulatory changes

- Enhancements to Collect’s compliance engine to cement our ongoing multi-market regulatory adherence

Especially with the development of AI, the industry is anticipating new compliance requirements. Laura touched specifically on the regulatory environment in the United States, where 18 states now have AI regulations in place. She highlighted the importance of making sure that customers have an ‘off ramp’ when using AI, and the option to talk to a human if they need to.

With new AI features coming to Collect in 2024, we’ll ensure they meet all necessary regulatory requirements before they’re launched in our key markets.

4. Customer portal evolution

Collect’s global reach means that we’re primed for rapid growth, with the ability to support an infinite volume of customers. To ensure that every customer individual still receives the ultimate collections experience, we’ll optimise Collect’s core feature - the self-serve customer portal.

86% of customers who resolve with InDebted self-serve using the portal, which highlights just how essential this capability is. During our Product Roadmap showcase, Pierre also shared that our customer to agent ratio sits at 2.9 million customers to just 80 agents. This demonstrates the sheer scale of Collect’s capacity and scalability, powered by self-serve.

To enhance the user experience, we’ll bring machine learning directly to the payment experience such as intelligent settlements. This feature recommends specific discounts for customers, based on our rich data insights. This allows our clients (who choose to offer settlements), to leverage our global data warehouse to increase both conversions and overall collections.

We’ll also enhance the ability for our payment plan customers to manage their accounts on an ongoing basis. This started with the release of calendar reminders last year, which had an unprecedented impact - customers who download calendar reminders are 17% more likely to maintain their payment plan compared to those without calendar reminders. Our ultimate goal here is to empower customers to manage their accounts effortlessly and more sustainably so they can get back on track faster.

5. ¡Hola! Mexico

In 2023 we launched our Spanish capabilities to support more customers in the United States, in their preferred language.

All the way through their collections experience - from managing their account in our customer portal, to engaging with our customer support team, our entire collections journey is now available in Spanish. When referred to InDebted, Spanish speaking customers can manage their debt using all digital and voice channels. With this functionality already live, this year we’ll extend our operations directly into the Mexico market. Driven by client demand, this will allow us to expand our relationships with existing multi-market clients and widen our global footprint. Stay tuned!

In summary

As we continue to further our collections intelligence, one thing remains the same. Our unwavering focus to change the world of consumer debt recovery for good with the best collections experience - with scalability, intelligence and customers at the heart. The technology we develop is ever-evolving, but our commitment? That’s rock-solid.

Learn more