NORTH AMERICA

The market-leading collections extension in the United States and Canada

Performance

AI and machine learning predict the best way to recover accounts across all ages and balance sizes.

Scale

The only solution you need for a world class outsourced collections operation, scalable across multiple jurisdictions.

Engage

Empower your customers with an omnichannel collections experience, available in both English and Spanish.

Multi-layered compliance

One world-class solution

Fully licensed and compliant with credit collections laws throughout the United States, including New York City.Customer engagement

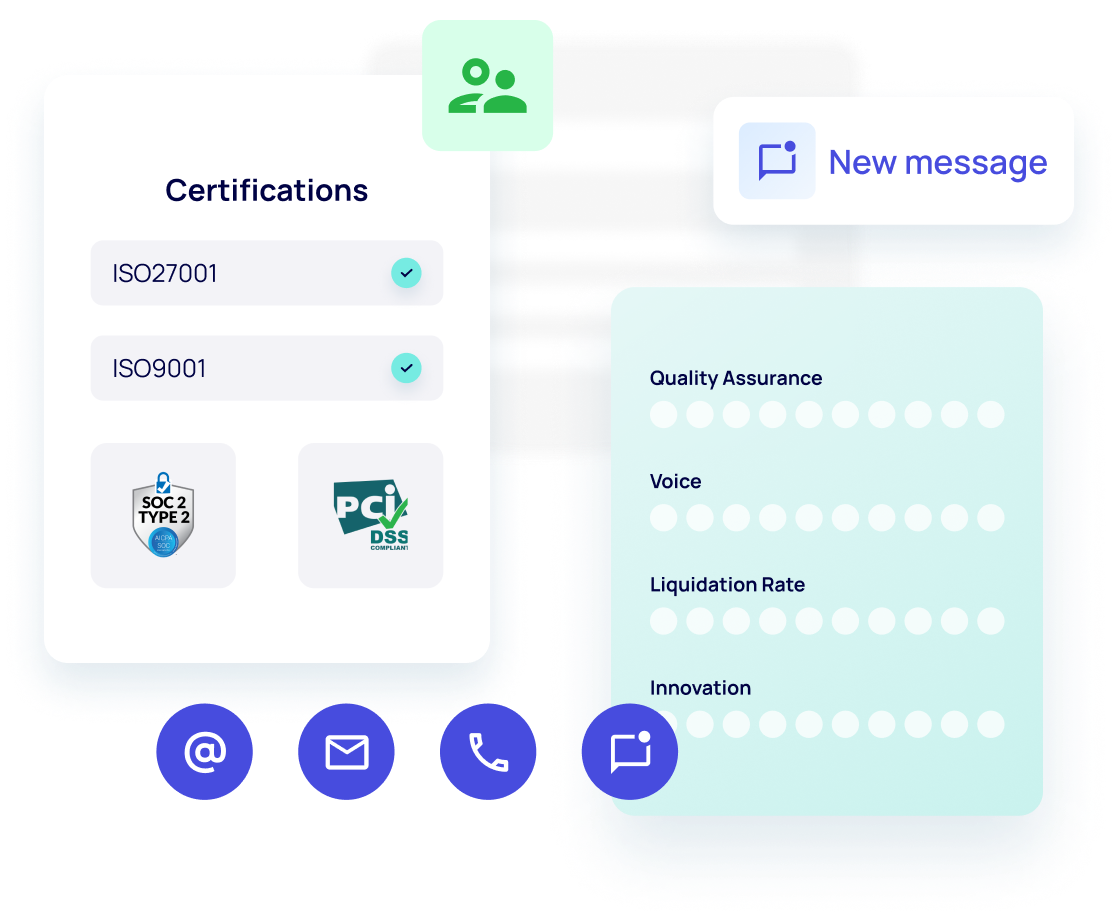

Our agents are backed by the right incentives, custom training programs, robust Quality Assurance and weekly coaching.Industry-trusted compliance and security

ISO certified, SOC 2 and PCI compliant, while our experienced compliance team works to ensure that your business—and customers—are protected.Access our Vanta Trust report

“Customer experience is critically important to Trustly, and InDebted’s omnichannel collections approach is core to how we support our loyal customers when something unexpected happens.”

Rakesh Teckchandani

Senior Director Risk Product

Up to 40% higher liquidation than traditional methods

86% self-serve rate

Make it easy for customers to resolve their balance, their way - without needing to speak with an agent.

See it in actionA better customer experience

Our team is here to support – with an average 4.9 star rating from 2,500 customer reviews.

Learn more59% higher Spanish liquidation

Connect with Spanish (MX) customers across voice and digital channels.

Read more

Trustly partners with InDebted to uplift their collections performance 20x

Challenge

- 2023 was a year of rapid growth for Trustly, reaching $58 billion in annual transaction value – a 79% YoY increase.

- In this period of growth, their monthly collections referrals increased 12x.

Impact

- Trustly’s collections performance increased 20x, successfully recovering $4 million USD in otherwise lost revenue.

- During this period, 70% of Trustly’s paying customers self-served their accounts, and 4 out of 5 have resolved their balance in full.

“We want to empower our customers to resolve their overdue balances in a way that truly works for their circumstances. InDebted makes that seamless. Finding a collections partner that can support our growth, while still providing an exceptional experience for our customers is a win-win.”

Rakesh Teckchandani

Senior Director Risk Product

Kristyn Leffler

Chief Product Officer

Laura White

Chief Risk & Compliance Officer

Brad Bone

Managing Director, US

Jag Khangura

Managing Director, CA

Find licensing information where you operate

Select a state to find more information

Enter into a new era of voice intelligence

Intuitive campaigns

Fine tune outbound calls to those who prefer them with personalised offers and better outcomes.

Training & incentives

Create positive conversations with a team that’s incentivised on consumer outcomes, not dollars collected.

Flexible payment options

Set customers up for success with repayment options that work for every situation.