UNITED ARAB EMIRATES

Fair, transparent and modern collections for UAE consumers

Personalisation

Digital-first solutions empower customers to manage their accounts with dignity and flexibility.

AI-powered

Generate 40% higher liquidation rates compared to traditional methods through our Machine Learning strategy.

Fair and ethical

Our incentive structure rewards our team based on fair customer outcomes, with no misaligned incentives.

Ethical principles, effective results

Supporting Shariah-compliant lenders

Maintain your values throughout the entire customer journey — including collections — with an experience rated 4.9-stars on average from over 2,500 Google reviews.Flexible payment options

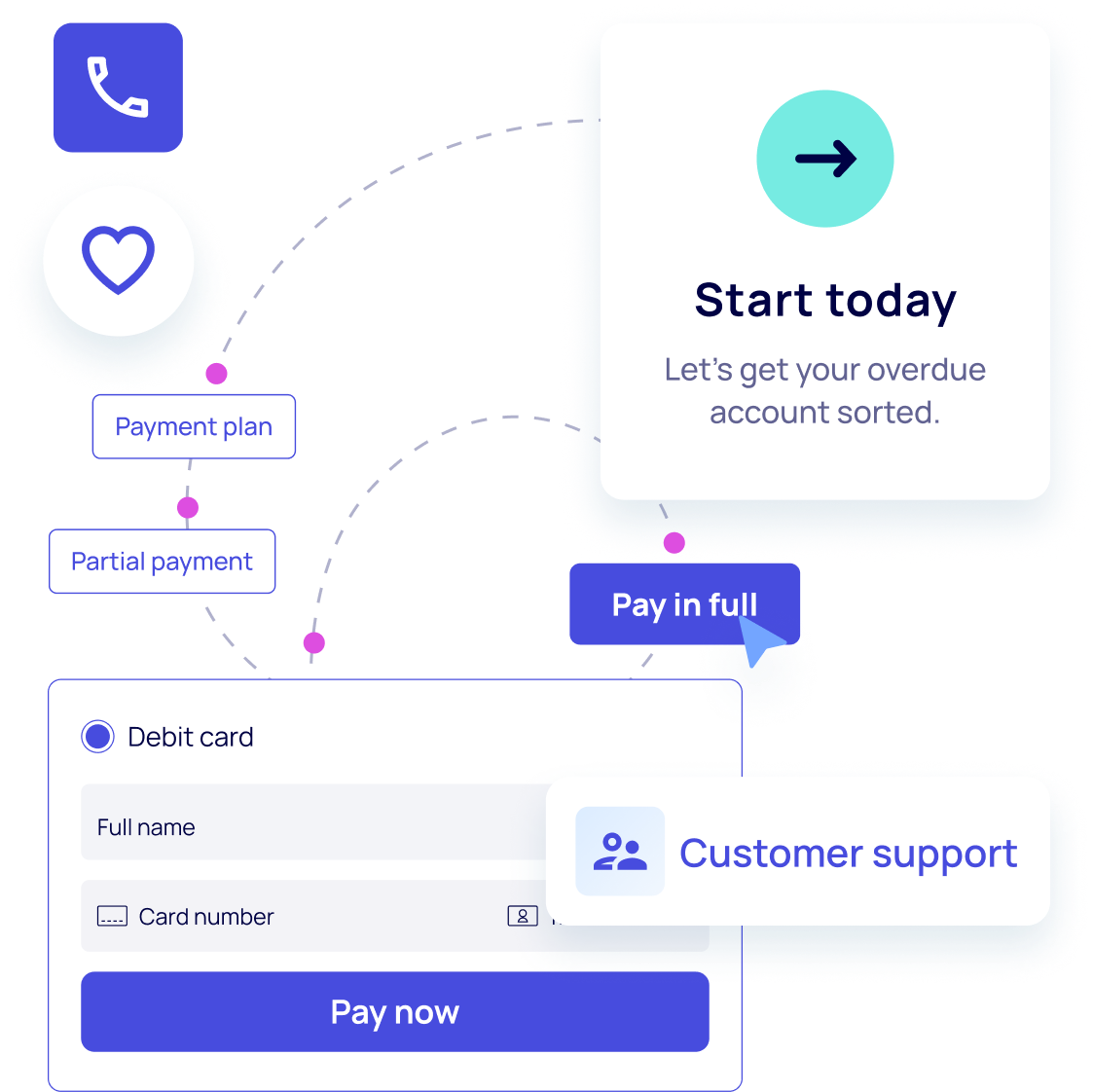

Including customisable payment plans, digital wallets and more, our payment options can suit each customer’s unique preferences.Complete self-serve capability

Built for transparency and convenience, 86% of paying customers resolve their accounts independently using our Customer Portal.Customer portal

Josh Foreman

Founder & CEO

Josh Stephens

Head of Customer Experience

Stuart Ahmet

Growth & New Markets Leadß

Built for high-growth Islamic Finance institutions

Multi-regional compliance

Local regulations are built into our infrastructure by code, ensuring collections activity is consistent with applicable laws and regulations.Customer experience excellence

Our digital-first solutions and leading Customer Experience Team empower customers to manage their accounts with dignity and flexibility.Human-centered technology

Combining technological innovation with human understanding, such as personalised strategies and culturally sensitive communication schedules.

Find licensing information where you operate

Select a country to find more information