LATIN AMERICA

A new standard for technology-driven collections

Personalisation

Using Machine Learning and AI, every customer’s journey is tailored to their unique preferences and behaviours.

Ease and flexibility

With an empowering omnichannel experience, 86% of customers resolve their accounts digitally.

Experience

Our agents are backed by the right incentives – with an average 4.9 star rating from 2,500 customer reviews.

For future-thinking organisations

Machine Learning

Informed by our Data Lake of over 1.8 billion customer insights, every step of each customer’s journey is responsive to their preferences.Flexible payment options

From digital wallets to customisable payment plans, empower your customers with sustainable options for every situation.Frictionless experience

Built for ease and convenience, our Customer Portal and omnichannel engagement remove barriers to resolution.Customer portal

“We are thrilled to partner with InDebted as we continue our journey to redefine financial empowerment in Mexico. Their innovative, consumer-first approach to debt collection aligns seamlessly with our values of transparency and trust.”

Angel Peña

CEO

Trusted by leading businesses

High-growth organisations partner with InDebted to offer their customers a modern collections experience.

See the customer experience

Josh Foreman

Founder & CEO

Josh Stephens

Head of Customer Experience

Stuart Ahmet

Growth & New Markets Lead

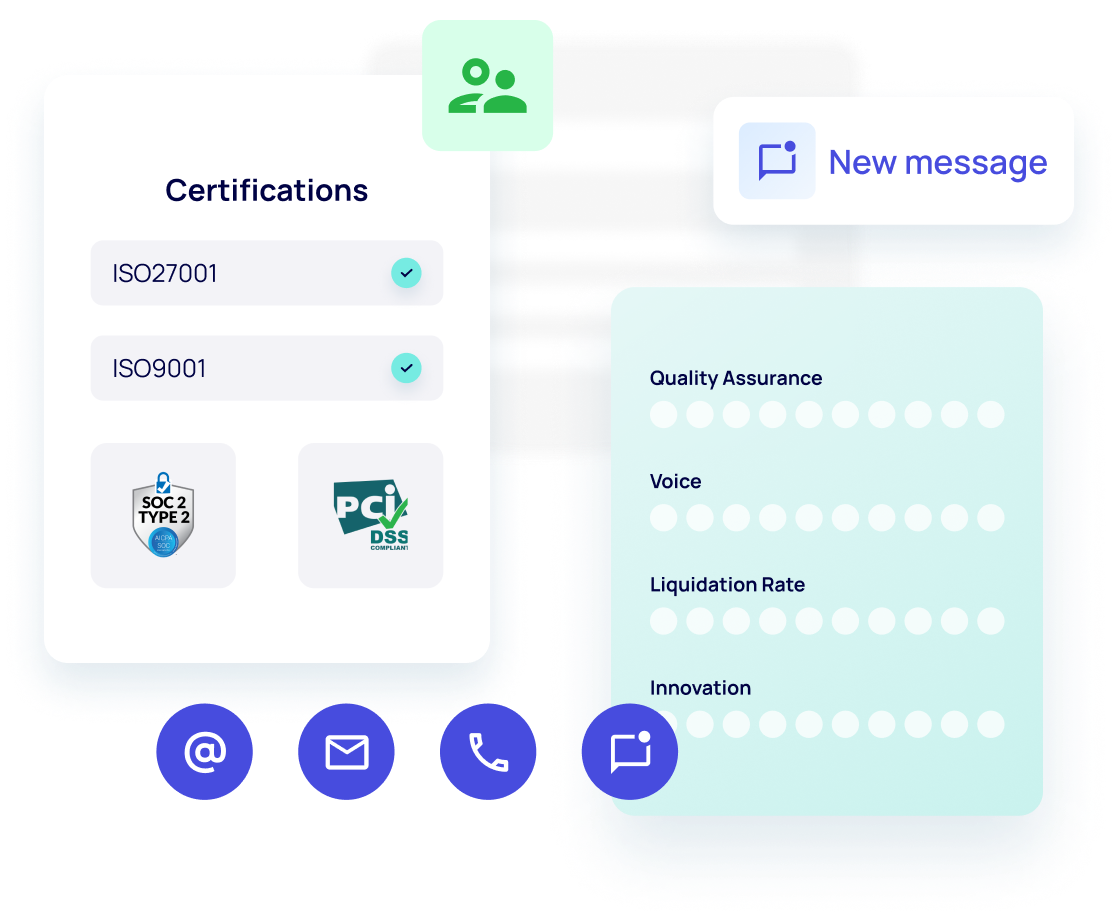

Industry-trusted compliance

Compliant by design

Local regulations are built into our infrastructure by code, ensuring collections activity is consistent with applicable laws and regulations.Customer engagement

Our Customer Experience team are backed by the right incentives, custom training, robust Quality Assurance, and weekly coaching.Enterprise-grade security

Secured to global standards including ISO, SOC 2 and PCI alongside our tenured Risk and Compliance team, our solutions keep your business and customers protected.Access our Vanta Trust report